2020 Markets Forecast

Nothing seems to stop the bull -2020 will continue the pattern of increases: Combining strong labor markets, rising wages, household sentiment, and central bank policies in the US and Europe will help stabilize the global economy at a low growth rate, economists and analysts largely predict that 2020 will be a year of slow growth – but No global recession is expected in 2020 or 2021 – is it the case?

On the other hand, the US stock market will be hard to keep up with double-digit prices, which is cut off from the rise of the aggregate business sector profitability at a very low single-digit rate. Continue to open such a gap over time combined A step back in China-U.S. trade relations &outcome of the U.S. presidential election Other geopolitical risks such as an escalation of Hong Kong unrest, Turkey, actions by Iran that threaten global oil supply and others threats from Europe

Let us not forget that 2020 is the year of the presidential election in the US – because of this, there is tremendous pressure from President Trump on the Fed to reduce interest rates which can lead to more profits in the stock markets

Tighter monetary policy will eventually be required, by either late 2020 or early 2021, which some analytics believe should ultimately push the global economy into recession and Price correction

Any increase in inflation that signals a rise in interest rates may be a risk factor for markets.

The lengthening of periods of economic boom and the reduction of the Depression came thanks to an expansionary budgetary intervention by governments and in recent years also to a monetary expansion of central banks.

In other words, low-interest rates and money printing.

Now markets are the longest business wave cycle ever.

Should markets continue to give monetary and fiscal policies a boost, or allow markets to do their thing without intervention until the next wave of business comes naturally?

Now on a personal note

I think 2020 will be an even more challenging year than 2019 in terms of surveyors and targets

I don’t think there’s a one-way ticket here – are we in late-cycle before strong correction ….

Although the prophecy was given to fools, I will try to take a bold step here and give a forecast

NASDAQ/ Dow Jones/ SP 500

Let’s start from light to heavy

Trend levels are respectively:

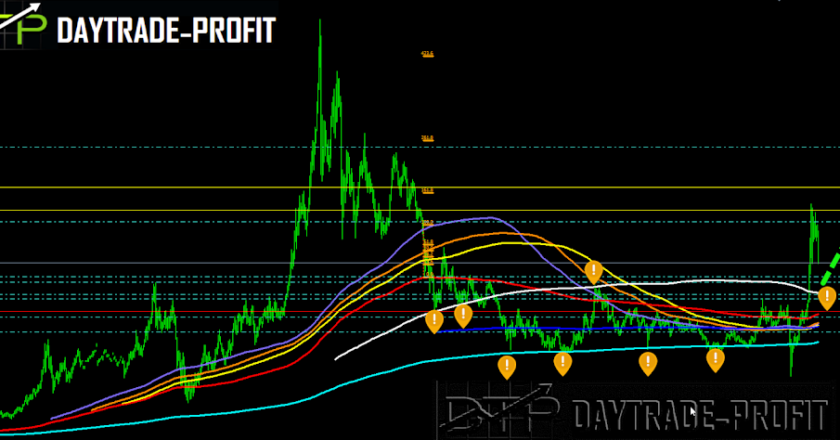

NASDAQ – 8360

|

| NASDAQ analysis |

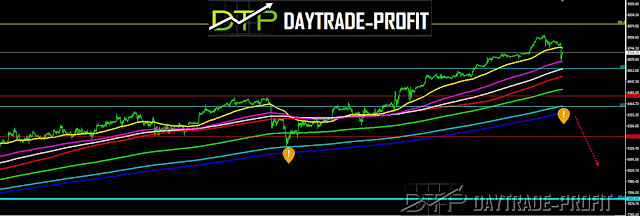

Dow Jones- 27600

|

| Dow Jones analysis |

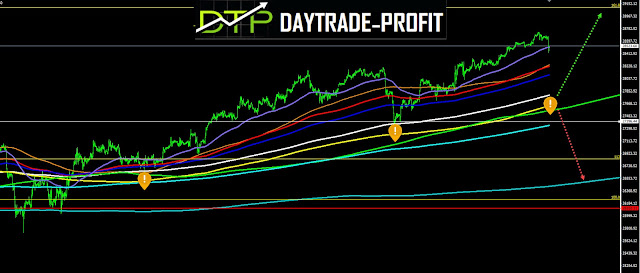

SP 500 -3110

|

| SP 500 analysis |

Now the hard part – what will be ….

A scenario that I think will happen in the markets

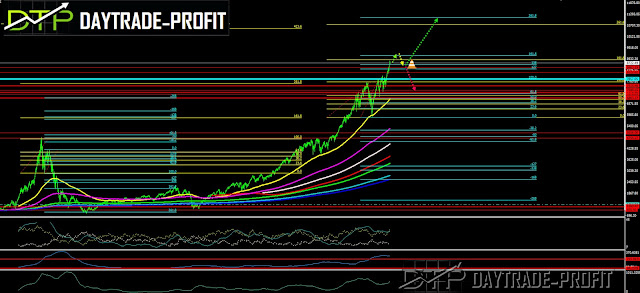

in my opinion, there is still where to go in the coming month into February

NASDAQ to the 9100 area

SP 500 to area 3320

Dow Jones to the 29130 area

From there, there may be an examination of the levels I have listed above – if they will be supported then Moving up will continue – for example, if you give the NASDAQ index

if not then expect to see the NASDAQ test again 6800 points

NASDAQ to the 10800-11200 area

|

| NASDAQ forecast |

one more last thing :

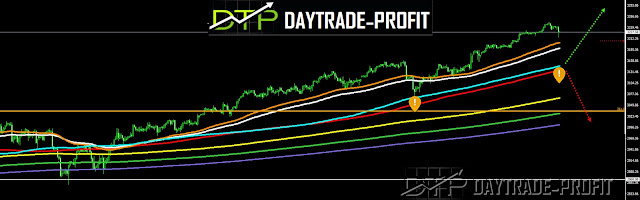

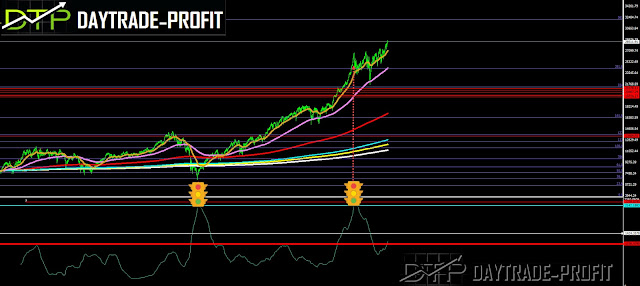

There is an oscillator I developed that I work with and he has already given me twice the market signals

One last time it was in 2018 – now it has not yet come to an end – just so you know

|

| DOW JONES forecast |

Next and future to come I will publish a review and analysis on currencies and commodities

GOOD YEAR for everybody

This review does not include any document and/or file attached to it as advice or recommendation to buy/sell securities and/or other advice