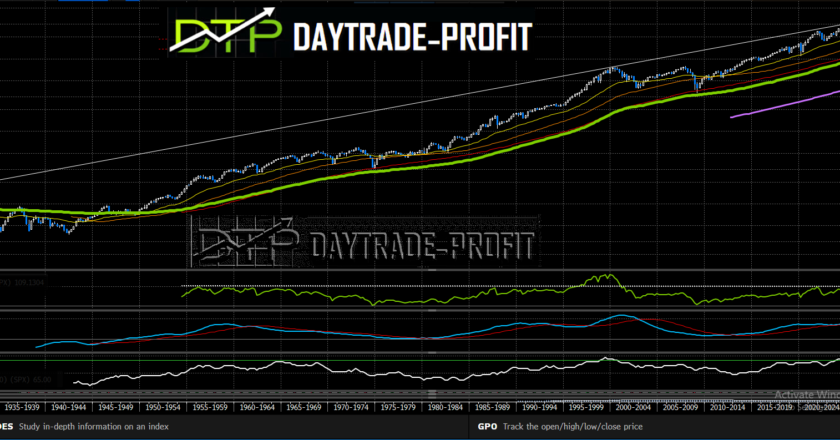

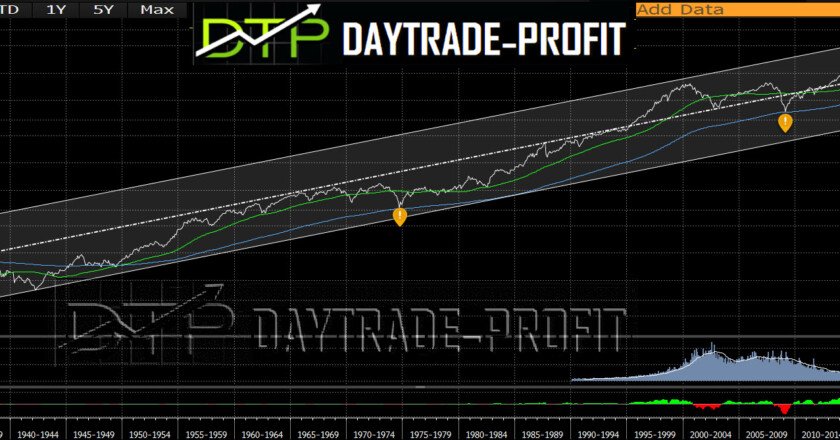

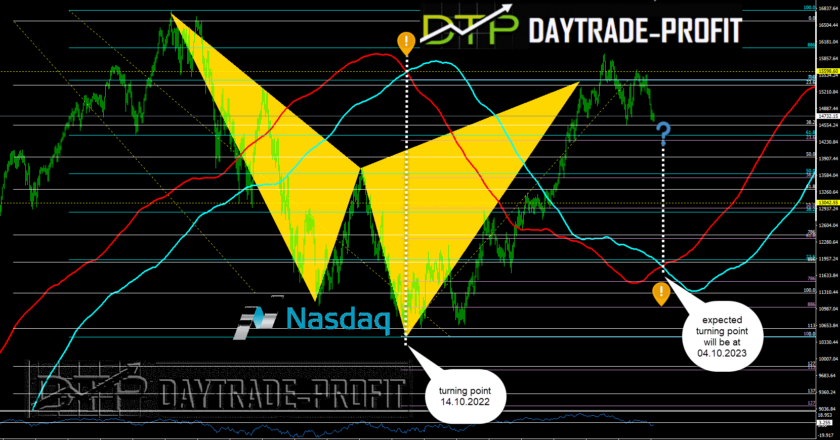

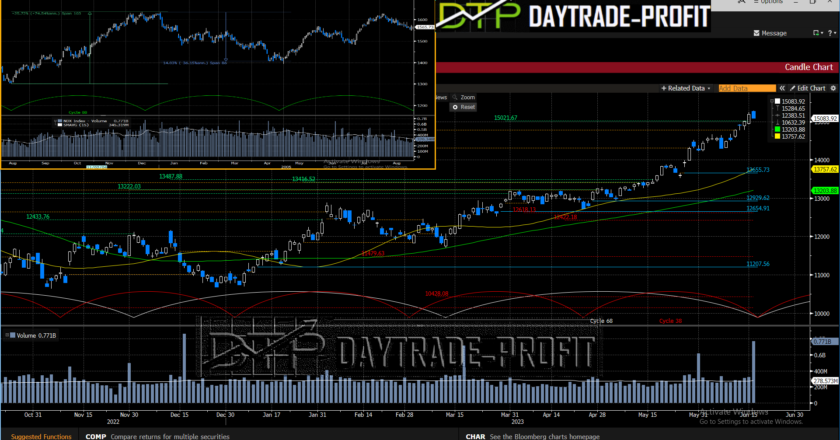

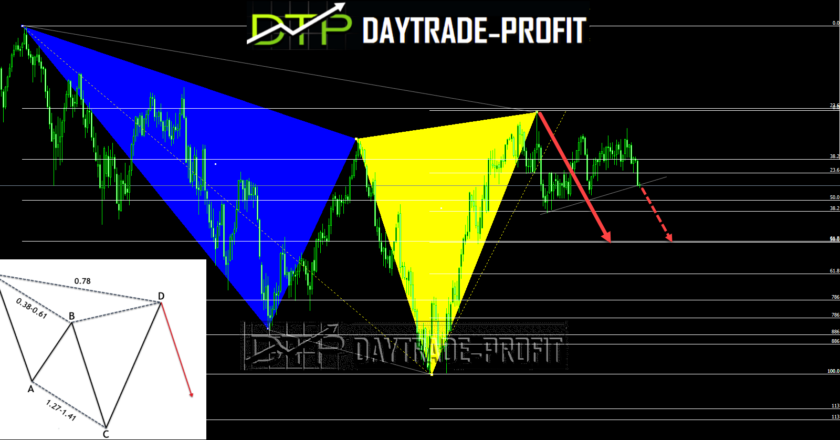

The S&P 500 in an Apocalyptic Scenario: Interpreting Harmonic Patterns Amid Global Turmoil In today’s world, the S&P 500 is being run to a new high despite unprecedented geopolitical tensions, military conflicts, and economic uncertainty. From Middle East turmoil and U.S. election drama to the Russia-Ukraine war and China-Taiwan tensions, Even in such as un understanding times, harmonic patterns like…