The Best Resources For Day Trade – Part Three

The Best Resources For Day Trade Part 1

The Best Resources For Day Trade Part 2

Be a daily trader, is to make the inhuman, that is, give up on human emotions guide our daily lives, and purchase habits of strict trade, expressed tracking orderly trading plan.

A novice trader, always finds himself moving between extreme moods of excessive joy, after days of gains as case, and frustration after a single day of losses. In the next article, I will present the only solution for developing trade capacity and is a professional trade journal writing

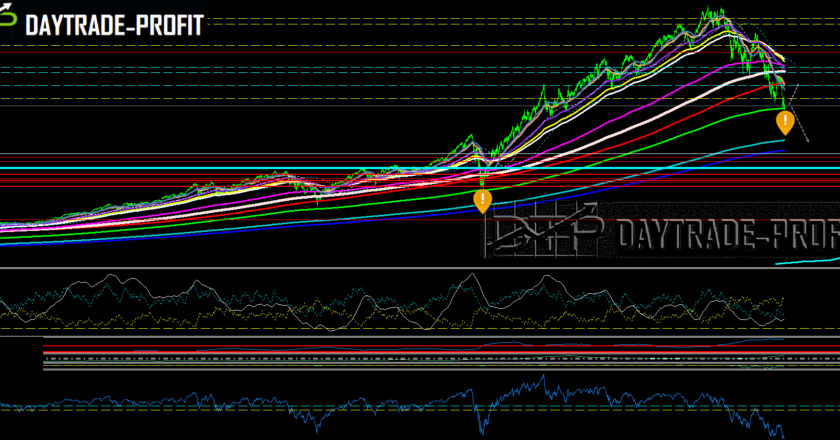

Description of existing situation

Every successful business man, will testify that track business performance is of vital interest to profitability and business efficiency. Whether he runs a high-tech company, or alternatively is a small shop selling, we can say with certainty that any business, without exception, monitors and analyzes the performance of its financial statements, maximize profitability. On the other hand, little is the number of followers and merchants constantly record their trading operations, and that they perform mainly on computer software was originally designed for actual trading. The reason is not due to lack of documentation evil intent, but rather more mental difficulties develop self-discipline

Stages of labor

|

| Day Trading Secrets |

The classic work style of leveraged trading, must take into account the tremendous pressure, day trade will experience during the same expectation entry position, and even more than that, during their stay in position. In order to succeed and win the battle against the greatest enemy of the trader, it is the trader himself, has to go through four stages

1.The first stage is the planning stage, at this point the day trader is out of the market, no opinion about the direction of the property. Expresses all his knowledge of the work of technical analysis in the form of lines and levels of action

2.The second phase is the registration, at this point the trader will record all the planning in knowing that he will come under pressure during emotional or irrational trading convince him that make “corrections” in trade as a result of fear or lust

3.The third phase is the implementation phase, this phase should be relatively simple and includes the placing any orders planned in advance, day trader, however, will be surprised to discover how different the original program it is planned versus actual trading carried out. With time and experience, the performance should be an exact copy of the design

4.The fourth stage, a completely separate step, is the level of thinking. At this point the day trader regret, wondering, respond, writhing, sweating and straining and all for nothing….. why ??? The design already exists and you have to let the market speak

Dealing with the stage of thinking is an innate characteristic and practice it for a long time, at least two or three years, to manage to control it (like long-distance running ability, for example). This training capability is performed on two main levels: stay true positions (trading experience) and journalist trade.

For real trading experience there is no way to help (even trading on a demo account) but independently journalist should not be difficult and complicated.

In the next article I will list several key points about what needed to be monitored all the trading operations, before, during and after the exit to exit a position

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice