World Markets Analysis

yesterday markets action shows the largest decline since December 2018 -it is a late-cycle sign the last post was about this action to come – what now? ,

*last week World markets closed positively after Wall Street indexes fell at the beginning week, closing at a historic high (only the Nasdaq index is at new highs), in light of positive macro data, such as the employment report that surprised and significantly beat forecasts.

The trade talks between US and Chinese officials technically will resume today, whether we are expected to sign the agreement or whether the timetable for the talks will be extended – but …..

President Trump tweeted on Sunday that 10% tariffs paid by China on $200 billion in goods will rise to 25% on this Friday, And, just to underscore his point, Trump also threatened to impose 25% tariffs on an additional $325 billion of Chinese goods also – This move seemed like a move that would burn the cards

An important figure for the coming week will be published on Friday in the US: the April CPI will show whether the Federal Reserve’s concern about inflation on the grounds that these are incidental factors is in line with reality. Last week the Fed left the interest rate unchanged and sent a message to the markets that interest rate cuts Not on the agenda – it will be interesting to see the inflation data, since persistent weakness may suggest a change in direction in Fed

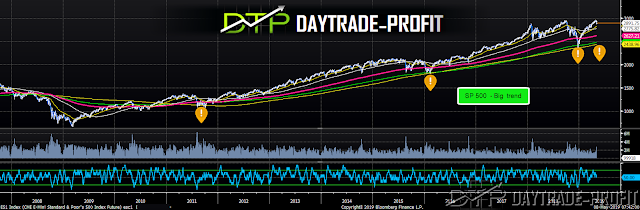

Technically view on the SP 500 index :

1. yesterday’s volume was the highest since last December!

2. support areas were on the line – while we need to watch closely today for getting approved for continuing moves

3. The big trend is still up as long 2430+_ points will hold

4.short term trend is mixing! – if 2863+_ points will break down – we should expect for continuing move to test 2805 +_ points – while hold above those level keeps the trend positive

|

|

markets analysis

|

|

| Sp 500 analysis |

Facebook has released reports yesterday and costs over 11% – comes to check the Gap, the refractive levels of the rising move: if it closes above the $ 171 area, we have a set up here to catch a move to close the top – it’s worth watching closely!

Amazon, as I have mentioned several times, should cross the 1760 area in order to show a continuing upward trend! If the conditions that I have mentioned exist, expect another incremental move

If not then the story is different:

This review does not include any document and/or file attached to it as an advice or recommendation to buy/sell securities and/or other advice