What Will Silver Be Like In the next Years?

From my last post at late June this year:

http://www.daytrade-profit.com/2015/06/silver-price-technical-analysis-forecast.html

Update for 22.11.2015:

Silver price continues the downtrend, The price of precious metals has strengthened slightly due to certain weakness in the USD amid the publication of FOMC Minutes on Wednesday

According to Thomson Reuters Release:” Total silver supply is forecast to fall to 1,014.4 Moz in 2015, down 3% from the previous year. This decline is expected to be driven by flat mine production, a 5% drop in scrap return, and net de-hedging of 12.6 Moz. Mine production is slated to total 867.2 Moz this year, up 0.3% from a year ago. This would be the weakest performance since 2002″

The Chinese economy is posting weaker growth numbers, Keep in mind that China is the world’s largest producer and consumer of silver. Even at seven percent GDP growth, demand for silver from China will continue to be robust. On top of that, China recently joined the LMBA silver benchmark-setting process. As a result, China will be pretty motivated to protect and shore up the value of its currency by adding silver to its reserves.

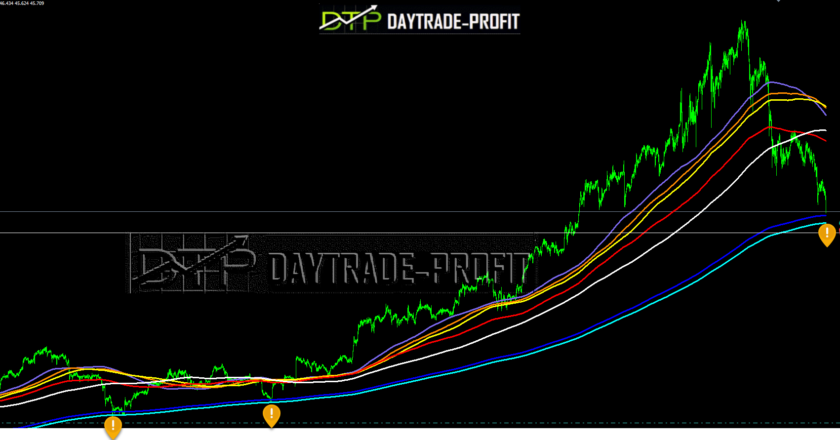

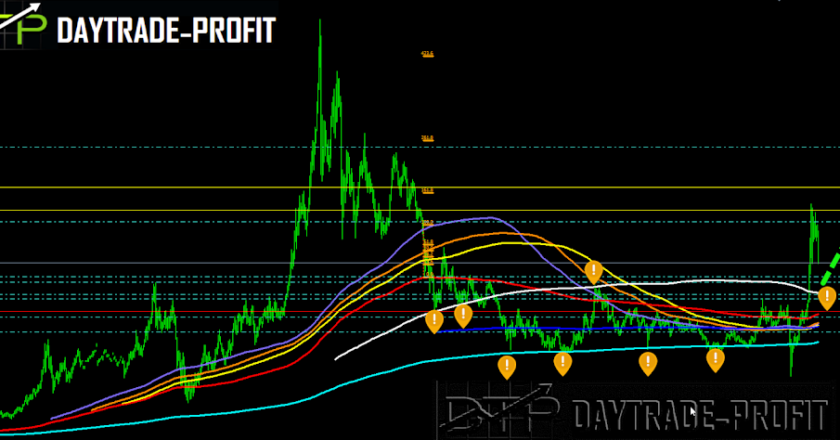

From the technical view:

Stay below 14.30 will lead to 12.50 area, immediate support is seen at 13.40, followed by $12.50 after. While rises above 14.60 will probably lead back to 15.30 16.20 -16.70 -18.00

The Major Cycle Low arrives, will remain in a bearish type correction for now

|

| silver |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice