AUD/USD Technical analysis forecast

AUD/USD rises up from last lows on the 0.70 price areas, near 0.73 following a decline in the US Dollar, is it the end for the bearish trend ?

Precious metals, especially Gold will likely help erode the Aussie base, as long as gold will trade on those levels

The Reserve Bank of Australia clarified it will not change interest rates anytime soon due to low inflation.

Australian dollar usually rises when commodities and stocks advance and when the risk appetite improves.

Australia exports metals such as copper and iron- enjoyed the high resources demand with China playing a key role. While peak investment is probably look a behind us

Risks could arise from the Chinese economy- the most important trading partner,could see a slowdown after us trade war between China and us .

|

| AUD USD analysis |

Technıcal analysis:

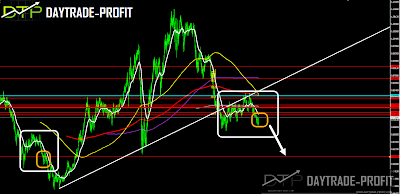

The Australian dollar has jumped last two weeks, is this could be a bullish breakout? Since January AUD/USD has been trading in a negative trend. We can see in charts the same pattern as was in 1998-1999

Assuming that the behavior is identical to what occurred in 1998-1999, I would have expected the continued weakening of the Australian dollar, the trend is negative as long as the Australian dollar is trading below 0.7460 +

Targets level stay in the 0.60 +_ price area

Resistance level stay in 0.7620, 0.7540, 0.7460. 0.7370

|

| AUD/USD chart |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice