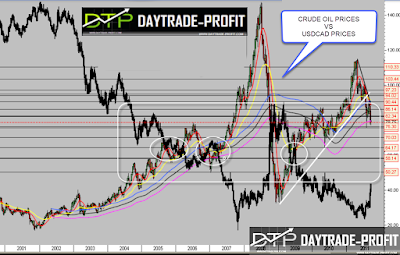

Trade correlation between the price of oil and Canadian dollar

The price of oil versus the Canadian price is not as balanced as it has been throughout history

There is a very big distortion between the two

I understand that there is a lot of politics now: positive pressure on Iran’s oil and the tension in the Middle East,

And the Canadian because the Naphtha agreement has not yet been signed and now leads to negative pressure on the Canadian

What I’m going to say and say is, if oil continues to rise then the Canadian will not stay in these numbers

Conversely, on the other hand, if the price of oil falls, then up to the level of the $ 53 zone, is still a big gap on the price of the Canadian, which has been for years in the region of 1.20 to 1.23

Currently, there is a state of distortion, because at the price of oil now the Canadian sat all the years at the price level of 1.07-1.09, and even if the oil dropped to the $ 53 area yet the Canadian price is somewhere behind and could return to the area of 1.20-1.23

|

| crude oil vs usd cad |

The conclusions I drew from the graphs :

Oil price in the region $ 50-53 = Canadian dollar 1.21-1.23 + _

Oil price in the region $ 62-64 = Canadian dollar in the area of 1.15 + _

Oil price in the region is $ 72-76 = Canadian dollar in the area 1.05-1.07

Oil price in the region $ 82-86 = Canadian dollar in the area of 1.03 + _

* Equilibrium over the years and the average intersection point between the two properties is in the regions of Oil price $ 62 against the Canadian dollar in the region 1.15

|

| USD CAD VS CRUDE OIL |

This review does not including any document and/or file attached to it as an advice or recommendation to buy/sell securities and/or other advice