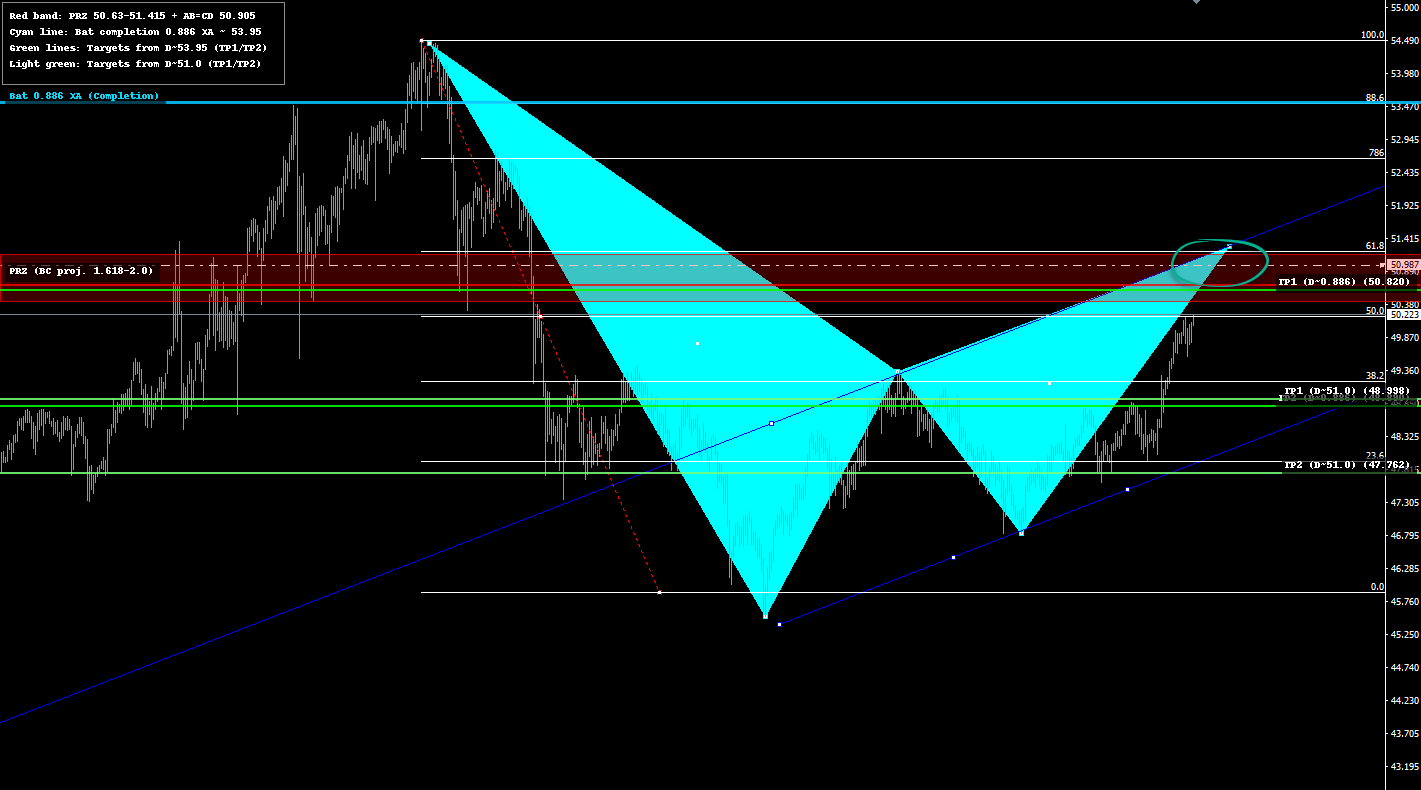

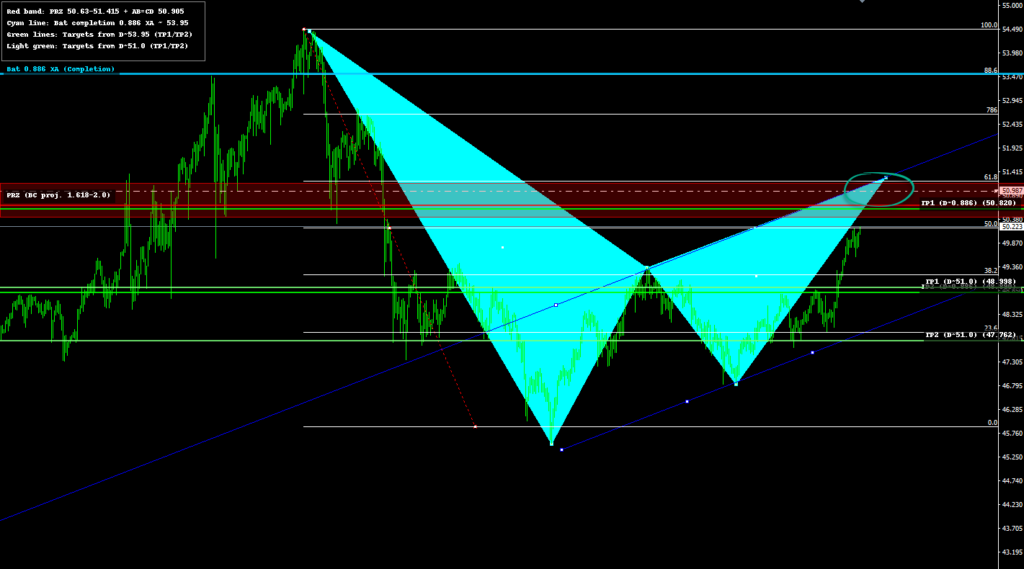

Bearish Bat Harmonic on the Chart: A Reversal Setup Worth Watching

On the current chart, XAG/USD price action is sketching a Bearish Bat: an elegant “M” that often precedes a disciplined pullback once buyers exhaust themselves in the Potential Reversal Zone (PRZ).

Snapshot

Pattern type: Bearish Bat (harmonic)

Primary PRZ: 50.63–51.415, with AB=CD ≈ 50.905 reinforcing the zone

Deeper Bat completion (0.886 XA): ~53.95

Invalidation: A decisive close above ~55.00 (X)

Why this setup matters

This Bat isn’t just “another pattern.” Multiple Fibonacci events collide in a tight band, concentrating supply where late buyers typically run out of steam. That confluence—BC projections (1.618–2.0) plus AB=CD symmetry—creates a high-interest area where risk can be defined precisely and managed tightly.

The PRZ explained

Primary PRZ (confluence zone): 50.63–51.415

Price reaching this band alongside weakening momentum or rejection candles often signals the turn.

Secondary PRZ (textbook Bat completion): ~53.95 (0.886 of XA)

A deeper push may still be consistent with the Bearish Bat before the reversal triggers.

Heads-up: A clean close above ~55.00 neutralizes the pattern.

Bearish downside targets (if reversal confirms)

Two plausible paths, depending on where D completes:

1) Reversal from the deeper Bat completion (~53.95):

TP1: 50.82

TP2: 48.89

2) Rejection inside the primary PRZ (~51.0):

TP1: 48.998

TP2: 47.762

Define risk:

Conservative: stop above X (~55.00)

Tighter: stop just above the active PRZ once rejection is confirmed

Manage the win: Scale out at TP1, move to break-even, and trail into TP2; let structure—not emotion—do the heavy lifting.

Quick FAQ

What is a Bearish Bat?

A harmonic reversal pattern built on Fibonacci relationships where D typically completes near 0.886 of XA, setting up a bearish turn.

Why is the AB=CD level important?

It adds symmetry and timing: when the AB leg equals CD near the PRZ, the probability of exhaustion improves.

Can price exceed the PRZ and still reverse?

Yes—especially with the deeper 0.886 XA Bat completion (~53.95). That’s why we map both PRZs.

This review does not include any document and/or file attached to it as advice or recommendation to buy/sell securities and/or other advice