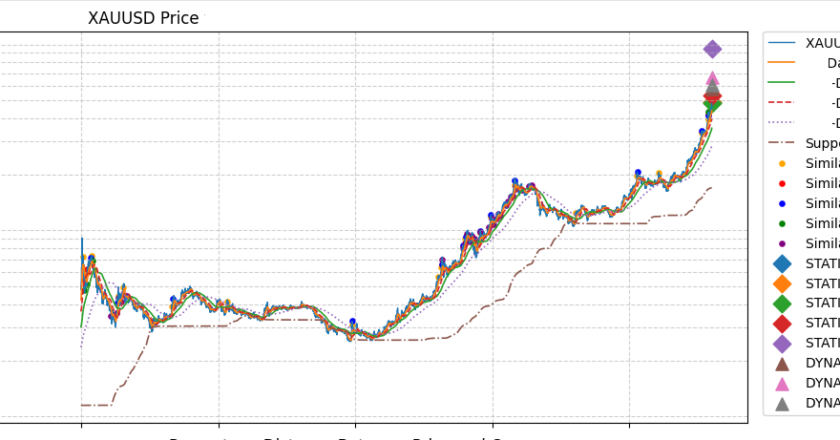

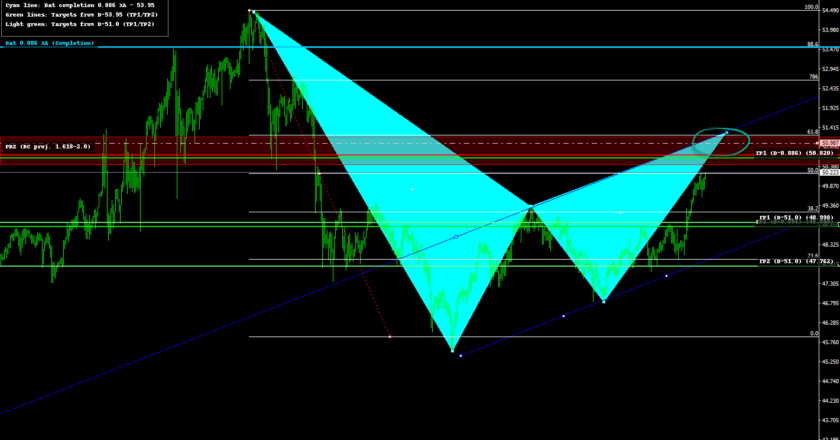

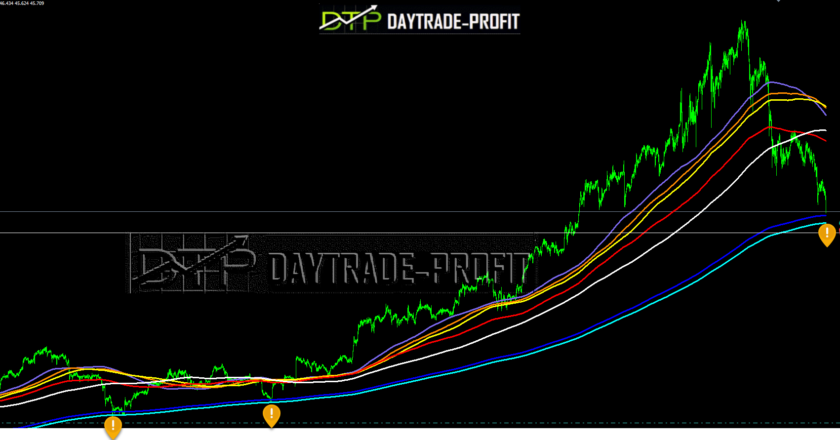

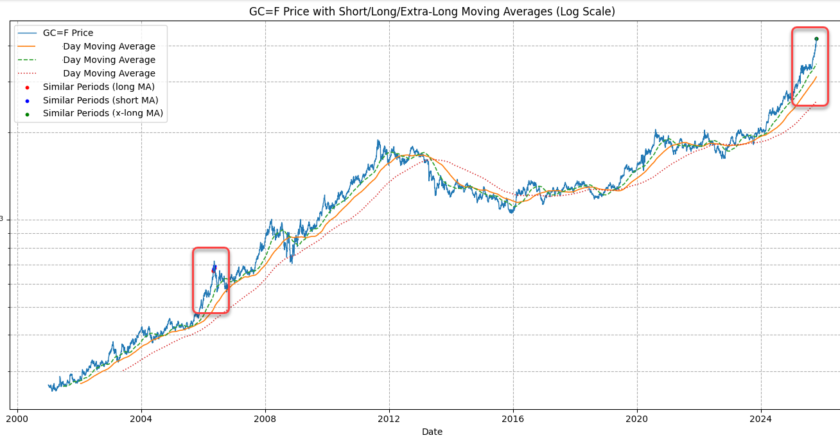

XAG/USD (Silver) Technical Review: Bearish ABCD + Bearish Cypher Two Scenarios This daily technical review maps two high-structure harmonic setups currently visible on the charts: Bearish ABCDBearish Cypher harmonic with a clearly defined PRZ (Potential Reversal Zone) Quick Scenario Map (Daily)Scenario 1 — Bearish continuation confirmsPrice fails at resistance/PRZ, prints rejection, and the daily structure remains bearish. Scenario 2 —…