Boeing stock analysis

Today morning Boeing surrendered and grounded the new model after President Trump earlier banned the 737 Max aircraft to take off or fly in the US airspace

Orders in tens of billions in danger – airlines are reexamining orders worth $ 57 billion

The Max 737 is considered A profitable model with a high order backlog of Boeing and is the company’s best-selling airplane model, so the crisis around it puts in jeopardy tens of billions of dollars in revenue.

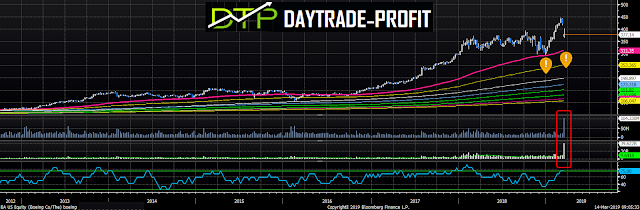

Yesterday Boeing share closed 0.5% higher on Wall Street – its first close in eight days, after falling more than 3% on the day. In the previous two trading days, the stock plunged more than 11% – the sharp two-day fall since 2009, which cut the aircraft manufacturer’s market value by nearly $ 27 billion.

Did you know that there are shares that tainted more than 1000%, Yes Yes you heard correctly:

Stocks like Boeing and Home Depot have grown at amazing rates ….

|

| Boeing analysis |

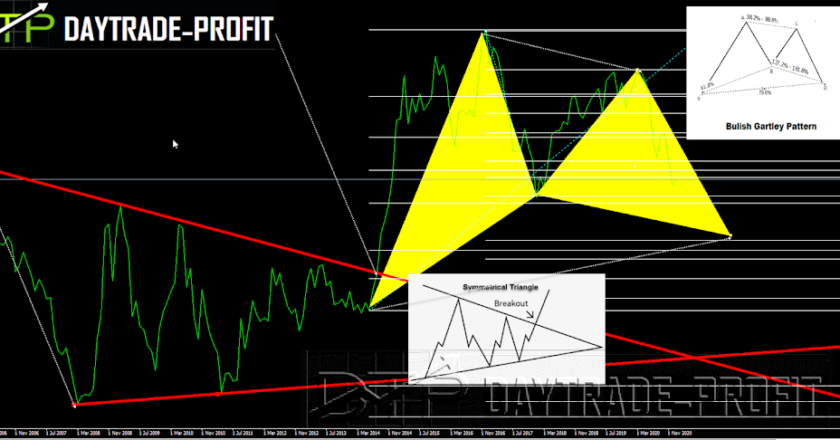

Technical Analysis of Boeing

You can see a number of things huge turnover vol in recent days not seen in recent years – it has a lot of significance, will these dive bring new buyers or will the money continue to emerge from Boeing share?

$ 311-315 is a support area- as long as the stock trades above the trend is positive

|

| Boeing stock analysis |

|

| Boeing chart |

This review does not include any document and/or file attached to it as advice or recommendation to buy/sell securities and/or other advice