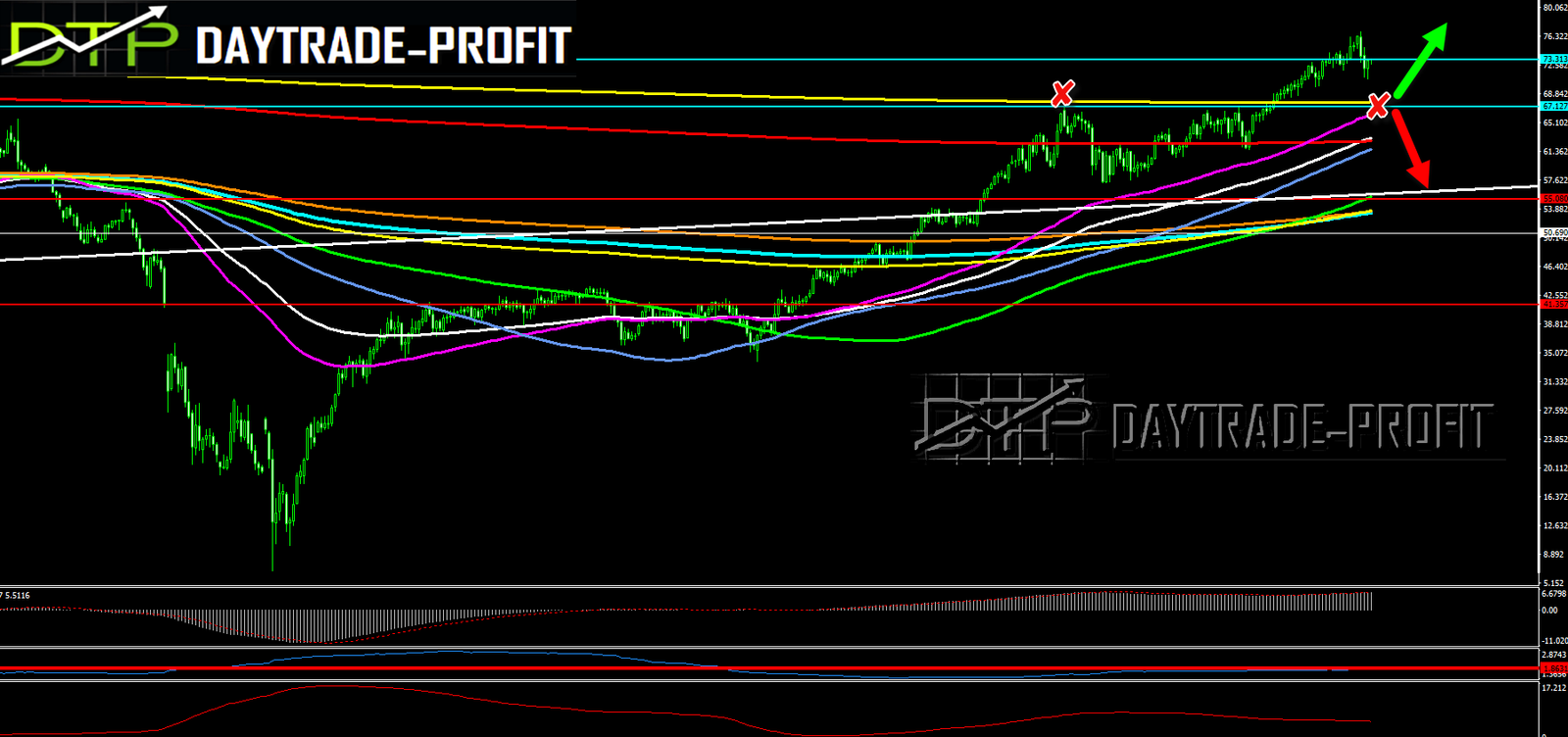

Crude oil price analysis

U.S. benchmark oil price WTI Crude hit its highest level since on Tuesday after OPEC on Monday called off its third attempt to reach an agreement over oil policy management for the coming months, but it didn’t hold those prices and we saw big declines in crude oil price, A solution is likely to be found, uncertainty in the short term affects the demand following the coronavirus pandemic, that is still here, and the evidence that the vaccines are not 100% effective, there are mutations that manage to outwit the vaccine, and the efficiency drops to 60%, – this will affect the flights, and as a result, of course also on the oil prices

we can see that the trend is supported by 67.80+_

The highest crude oil prices and the lowest U.S. cost of production, are an unfavorable combination for rising prices if the rules of economics, supply, and demand apply. The average production costs price-to-cost ratio is high Approaching 2x

Oil producers in Texas — are likely to prevail at such a low supply cost, and we see that they took short position cover on those prices…..

EIA source: https://www.eia.gov/outlooks/steo/report/prices.php

“we expect that recent increases in crude oil prices along with the OPEC+ decision to raise production will help meet the expected increase in global oil demand and lead to relatively balanced global oil markets for the remainder of the forecast period. Despite strength in oil prices during 1H21, we expect moderate downward oil price pressures to emerge beginning in 2H21, when we forecast global oil production to rise and cause inventories to draw at a slower pace. We expect global oil inventories will fall by 0.2 million b/d in 2H21, compared with an average draw of 1.7 million b/d in 1H21. We forecast Brent spot prices to average $71/b during 4Q21 compared with the average of $73/b in Jun”

Trade OIL with ZERO Monthly rollover fees

This review does not include any document and/or file attached to it as advice or recommendation to buy/sell securities and/or other advice