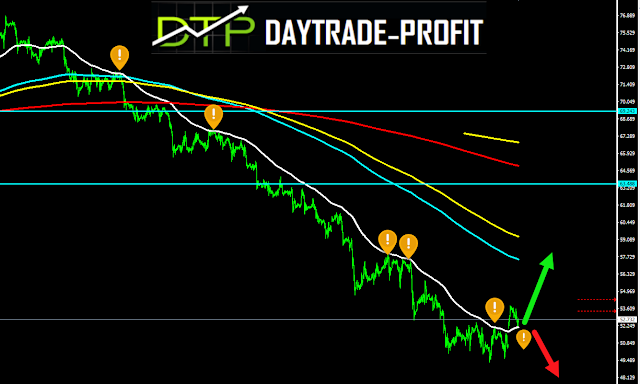

oil prices technical analysis

Oil prices jumped sharply on Monday after the US and China agreed on 90 days at a weekend meeting at the G20

Last Friday, the price of oil stood at $ 50.70, yesterday’s opening, the price jumped to $ 52, leaving Gap behind – an open price gap that will likely close sooner or later

The question is what is next?

The last post was Are we need to be prepared for Crude oil Prices To Rebound

it was so expected and I wrote it for you: “Is there a negative deviation between the oil price and the technical parameters on charts ?”

In 4 /7 I posted this:”crude oil showing suspicious signs”

|

| oil technical analysis |

Crude oil technical analysis

Its the first time that price has traded above the white band!

After the big drop last month, the trend has changed to bearish and 64 $ oil price level became resistance level, now we need to watch on 54 -55$ price area that may become short-term resistance area also, I am expecting to see retracement on those level to check again 56- 60$ price area if 57 will break up this round

Break above 57 +_ levels price will send crude oil to cope with the 60+_ price level, while stay below those levels will show us that this is just the beginning of a great journey down

|

| Crude oil analysis |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice

www.daytrade-profit.com