🟡 GOLD Overextension Alert: A Rare Price Dislocation from the Mean

📅 Date: October 15, 2025

📌 Key Insight: Gold Is Trading at Extreme Distance from Long-Term Averages

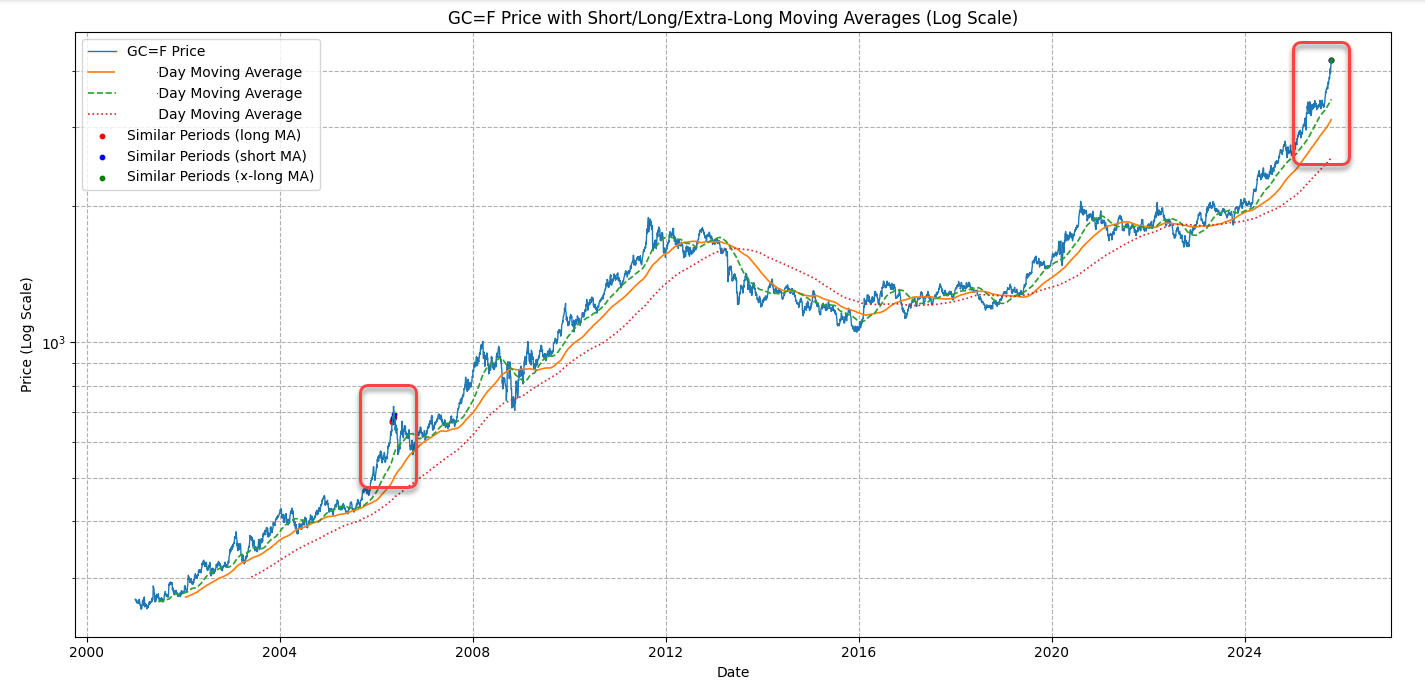

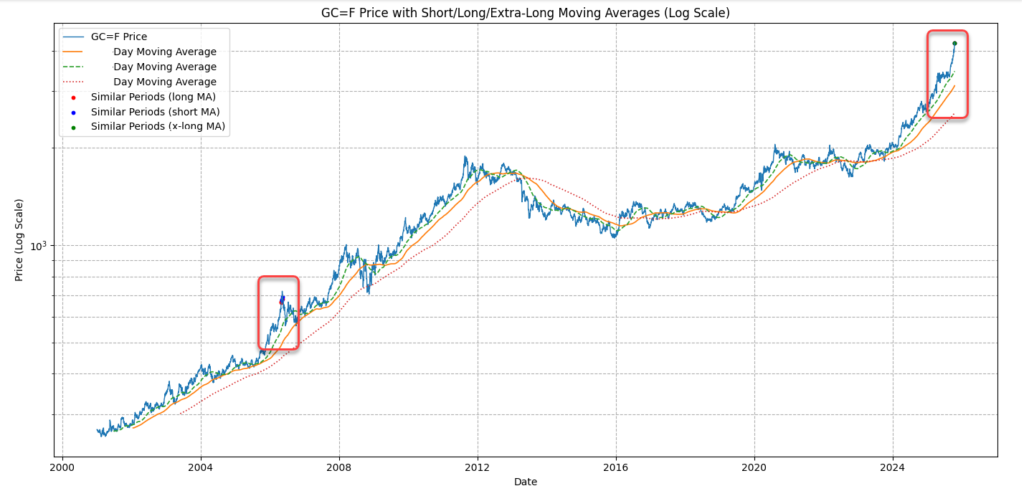

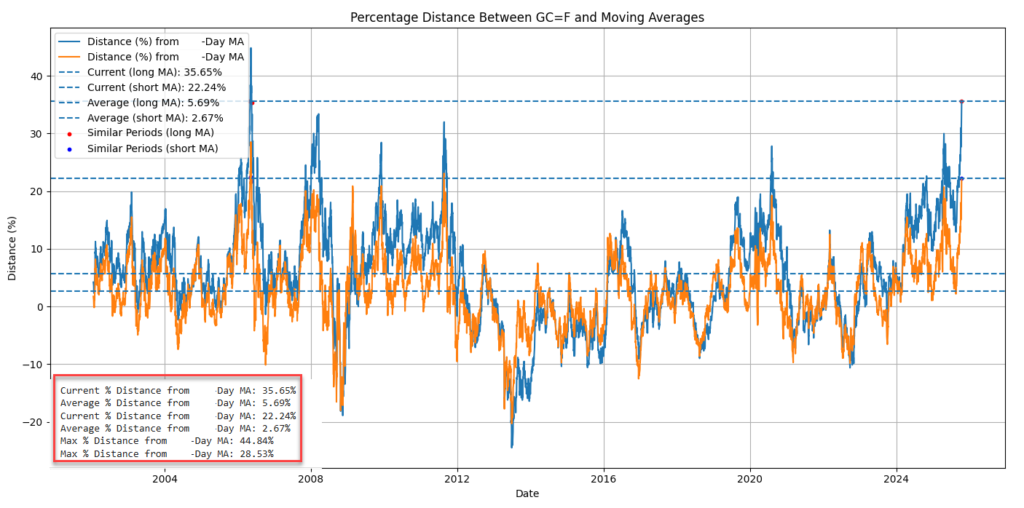

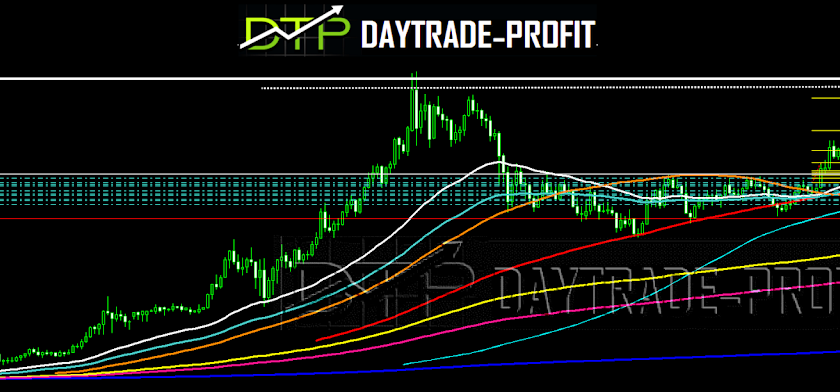

The chart below tracks the percentage distance between Gold (GC=F) and its key moving averages. The current reading is flashing a historical red flag: Gold is now trading 35.65% above its long-term moving average and 22.24% above its short-term moving average — a level that has only been exceeded once in over 20 years.

🔍 Chart Breakdown

✅ Metrics from the Lower Chart (Distance % from MAs):

| Measure | Value |

|---|---|

| 🔹 Current Distance from Long MA | 35.65% |

| 🔸 Current Distance from Short MA | 22.24% |

| 📉 Average Long MA Distance | 5.69% |

| 📉 Average Short MA Distance | 2.67% |

| 🔺 Max Long MA Distance | 44.84% |

| 🔺 Max Short MA Distance | 28.53% |

The last time Gold reached this kind of separation from its long-term average was during the 2005–2006 bull run, which was followed by a multi-month sideways correction before resuming its climb.

🧠 Interpretation: High Risk of Short-Term Mean Reversion

Gold is clearly in a strong uptrend, but the current deviation from historical moving averages is extreme. This distance has only occurred a handful of times since 2003, and it usually signals:

- A cooling-off period, or

- A pullback to moving averages (short or long-term)

Such extensions often precede rebalancing moves, even in powerful bull markets.

🎯 Trading Implications

🧾 Bottom Line

Gold’s price is nearly 6x above its average deviation from long-term trends.

This doesn’t mean a crash — but history suggests a mean reversion is likely.

Expect volatility, and look for lower-risk entries if you’re bullish long-term.

📉 Ideal Support Zones to Watch:

- $4,150–$4,180 (short MA)

- $4,000–$4,050 (long MA / prior options OI magnet zone)

- Gold COT + Options + Technical Outlook

🧾 COT Report – Strong Speculative Longs

📅 Latest Report Date: September 2, 2025

| Group | Long | Short | Net Bias |

|---|---|---|---|

| Managed Money | 127 | 21 | ✅ Very Bullish |

| Swap Dealers | 18 | 31 | 🔻 Hedging (not directional) |

| Other Reportables | 104 | 65 | ✅ Mild Bullish |

🔍 Summary:

- Managed Money (hedge funds, CTAs) are extremely long-biased, with very few short positions.

- Swap Dealers are net short, typically acting as liquidity providers rather than speculators.

- Other Institutions are net long, though more balanced.

✅ This confirms a strong conviction behind the Gold rally from the institutional side.

📊 Options Market Sentiment (OGF6)

- Put/Call Open Interest Ratio: 0.87 → Moderate bullish bias

- Put/Call Volume Ratio: 0.26 → Heavy short-term call buying

- Key OI Support Zone: $4,000–$4,200

- Current Futures Price: $4,255.50

🧠 Interpretation:

- Most call open interest lies below the current price — many positions are already in the money.

- The market is skewed bullish, but this also implies potential profit-taking or volatility spikes on any pullback.

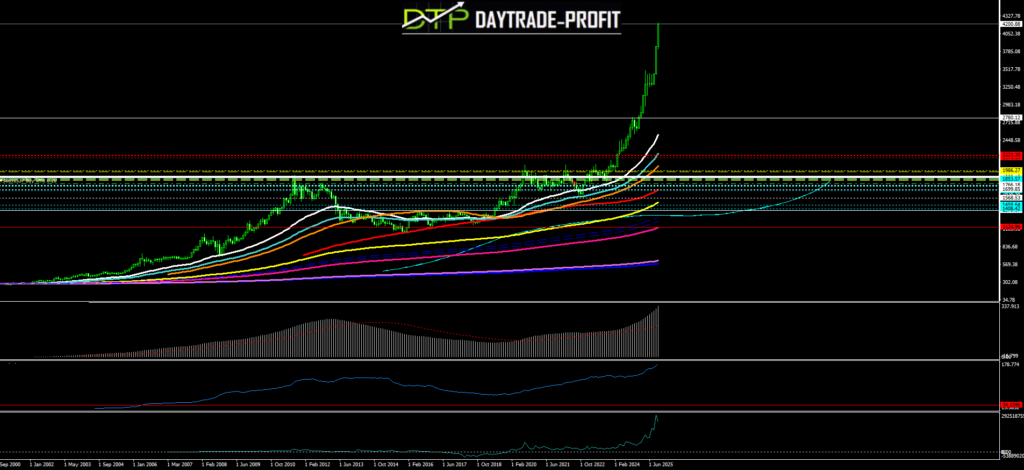

📉 Technical Structure

This review does not include any document and/or file attached to it as advice or recommendation to buy/sell securities and/or other advice

2 Comments

obsidian backlinks example

Regards for all your efforts that you have put in this. very interesting information.

admin

THANK YOU