GOLD FORECAST

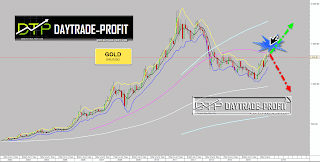

lets start with the important thing and this is the 1360-1380 price levels

you need to be focus on those levels – as long as gold will not cross those levels up (1383$)

the trend is not bullish yet -Upward movement came from the low on $ 1040 price

Is set during installation/correction for now

If we look at long-term perspective, we can see that the region of 1320-1380 is a critical area

|

GOLD FORECAST |

Last week gold ( xauusd ) took off and tested 1367$ after UK decided to cut interest rate from 0.50% to 0.25% . But after US nonfarm payroll better than expected data it melted like ice and crashed from 1367$ till 1335$ , It closed on lowest point of the week at 1335$ .

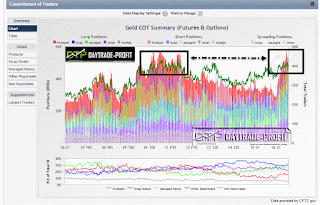

This week, focus will be solely on the charts. There is so much going on in the world and with the election in the United States, but the reality is price is still under the control of Chinese buying at bargain prices while the West’s central bankers try to keep alive the “ponzi scheme” facade regarding gold.

More thought needs to be given to what practical role gold and silver would play once the Federal Reserve “dollar” loses its status as a reserve currency and receives the recognition it deserves, a third-world nation with a worthless paper fiat currency. How will precious metals holders benefit, and to what use will their holdings be placed?

Friday’s high volume accompanied the selling, and that suggests either a retest of the lower , or several more before buyers can regain control. Now a read of the opposite is required, how price reacts on the decline to indicate a change in sentiment from sellers back to buyers.

An important thing that caught my eye ,pay Attention to COT state positions It starts mentions the moves of the years 2011 to 2012

|

| gold position |

Technical analysis:

|

| GOLD technical analysis |

|

| xauusd technical analysis |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice