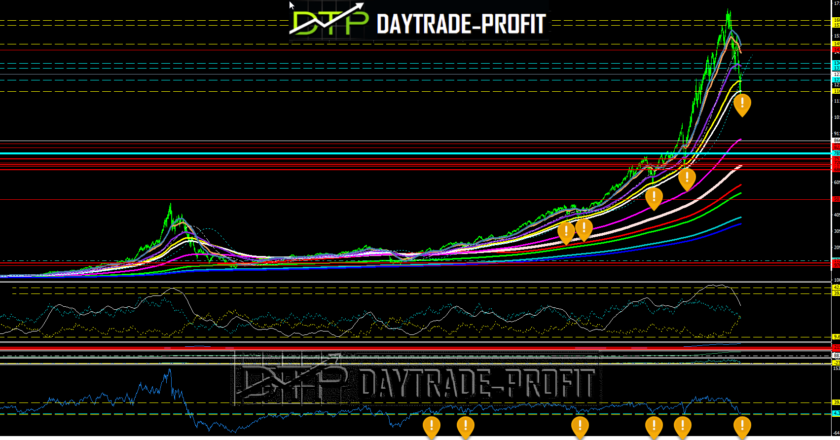

Let’s look at what’s going on right now current chaos in the markets

We will examine what happened to the indices since the beginning of the declines on 26.11.2021

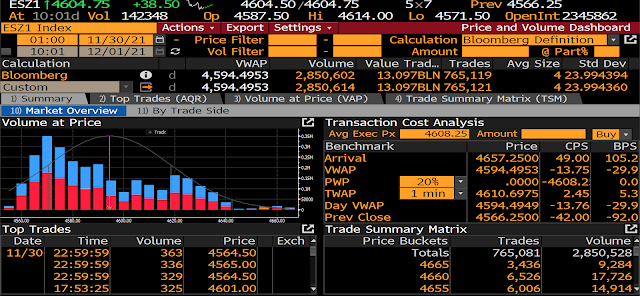

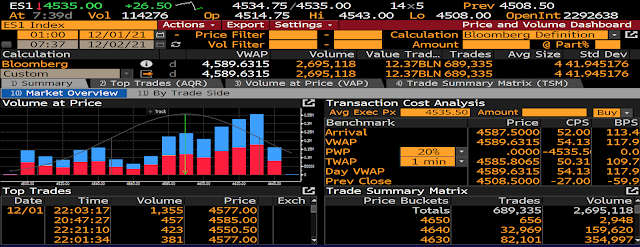

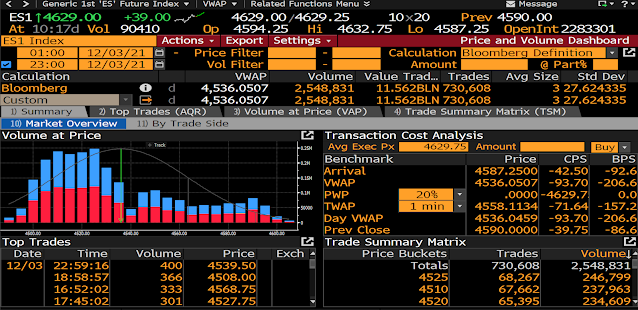

I took for example the most negotiable contract in the world which is for the S&P 500

26.11 Beginning of the decline – average volume – critical points of trading were made at a price level of 4610

30.11 Continuation of the decline – average volume – critical points of trading was made at a price level of 4560

1.12 Large trading range in combination with high volume, examination of the high area of the previous day in area 4650 and then continuation decline – average volume – critical points of trading was made at a price level of 4580 – a critical day in terms of price and volume combinations

3.12 currently appears to be below for the current downtrend – combined with high volume critical points of trading were made at the low price levels of 4520

6.12 Gap opening at the beginning of the trading week, closing the gap and running strong up Average Volume – Critical points of trading were made at a price level of 4580

in my opinion – the danger will pass only when the price closes a day above 4650 Points

Important price levels

4650

4610

4580 – large impact trader volumes were In this price segment!

4520

Markets prediction for the following years

This review does not include any document and/or file attached to it as advice or recommendation to buy/sell securities and/or other advice