New Zealand Dollar Technical Analysis Forecast

New Zealand dollar extended its decline to a seven-week low, as growing speculation the Federal Reserve will hike interest rates this month

Reserve Bank Governor Graeme Wheeler said:

“New Zealand would not fare well in such circumstances. Even if our exports of goods and services to the US – currently over $8 billion – were not directly subject to higher tariffs, we would be hard hit by a downturn in the global economy, including among our main trading partners, in response to the direct and indirect impact of protectionist measures. We would experience lower global demand and weaker commodity prices.

It would not be all good news, however. Longer-term interest rates would rise, reflecting an increase in borrowing by US Government, pulling longer term interest rates here higher too, which would flow into higher mortgage rates”

New Zealand’s trade balance deficit widened to 285 million NZD, worse than expected. The publication took its toll on the kiwi, but the currency eventually recovered, also thanks to an upbeat measure of commodity prices, up 2% as well as better terms of trade, a rise of 5.7%. The US dollar enjoyed optimism about a March rate hike but suffered from the Donald Disillusion. Eventually, the Federal Reserve had the upper hand, and the greenback won over.

Those words reflect the delicate situation for NZD economy – NZD has slipped further after its significant underperformance last week, Breakdown 0.7000 under this morning. An expected chunky fall in dairy prices in the GDT auction tonight is not helping sentiment. Falling prices on the NZX futures market has reduced the upside risk to Fonterra’s payout projection we previously saw. we reduced our forecast milk payout for the current season by 30 cents to $6.10. Indicators suggesting a weaker housing market are not helping either.

|

| New Zealand dollar |

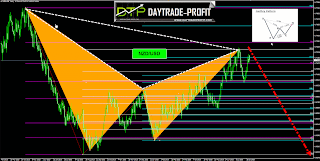

Now let’s focus on the technical side:

here we have two important things, they could Tell the whole story The kiwi faced a downside pressure and closed bearish

NZD/USD is trading narrow range for a long time, it seems to be having trouble breaking long-term resistance at 0.7340

Pay attention to the pattern – it could be that we see here gartley pattern’ this the situation so we should expect to see lower number below the last lows, while break above 0.7340-0.7460 could take him to 0.79 area

The NZD/USD might need to see further strength to move above the 0.7340-0.74400 resistance, which could indicate make new highs at 0.79 area; break below 0.6940+_ may expose what could be another step down below the previous lows key resistance area below the 0.6760 level

One more thing:

See the similar moves that happen in 1999

break down0.6670-0.6780 will lead nzd to lower prices 0.61′ and even lower to 0.53-0.59

|

| nzd usd pattern |

This review does not including any document and/or file attached to it as an advice or recommendation to buy/sell securities and/or other advice