Crude oil Technical analysis

And once again it happens…

The technical is ahead of the market in its moves

This is said about the technical missile -lol

Last post I talked about the feasibility of an oil price increase based on the same pattern

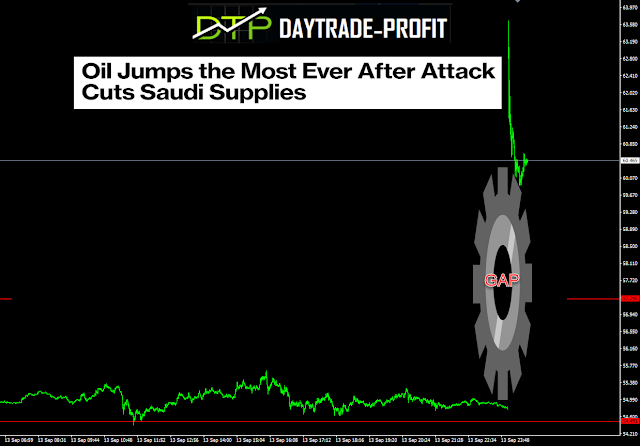

The attack in Saudi Arabia led to the opening of the trading week

Oil Prices Close 15% Higher On Record Trading Day

It turns out now that the situation is not as serious as initially thought – Saudi Oil Outage Impact Not As Bad As Predicted

But is that really the case? The question is the real thing behind the injury and is the boldness and thought of the future to come. Is it embodied in the price?

This story never ends in my opinion

The question being asked now is what’s next?

Looking at the graph you can see a number of things

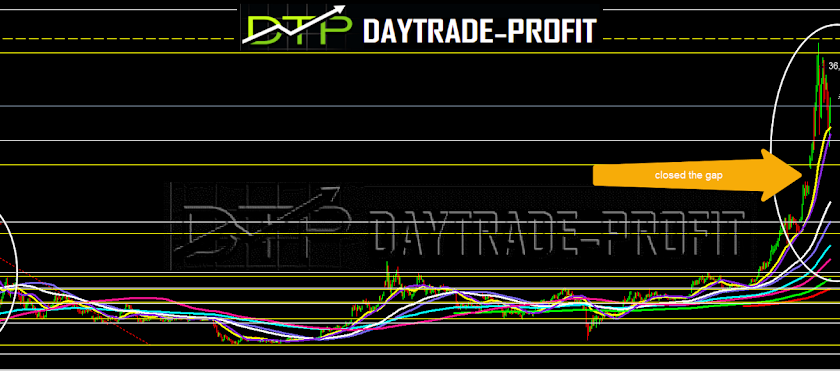

A big gap opened at the start of trading this week – when will it close?

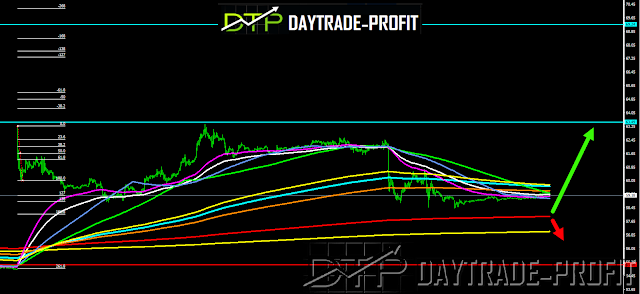

In terms of short-term oil has shifted to positive, with traders having to focus on several points:

As long as the $ 58 level is maintained on a daily basis the direction is up

When in order to strengthen the long should see repetitive migration above the $ 61.80-62.30 level

Breaking the $ 58 level will most likely lead to the Gap closing with feasibility to meet the $ 53 zone, much like what I noted in a previous post on the trading pattern that appeared in the past

Long-term :

As long as oil trades above the $ 53 price level the trend is positive

|

|

|

|

| Crude oil forecast |

This review does not include any document and/or file attached to it as advice or recommendation to buy/sell securities and/or other advice