Is the Turkish lira on A temporary respite

The last move we see in the Turkish lira stabilizing against the US dollar, After Turkish lira having already lost nearly 40 percent of its value this year against the dollar, It has since recovered somewhat but is still down some 30 percent, year-to-date. Are we going to get a new era on Turkish lira price movement?

Turkey’s economic problems are structural: For years, it juiced economic growth by building infrastructure, high inflation, and high interests that won’t go away just because sanctions do, we saw 25% inflation economic data released while central bank vowed to stick to a 5 percent inflation target – despite the lira crisis sending the rate soaring to a 15-year high.

|

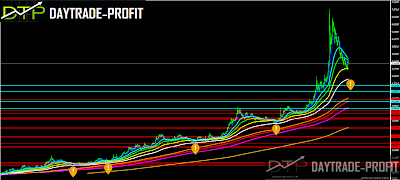

| Turkish lira |

To simplify the situation of the Turkish lira, here is the story

|

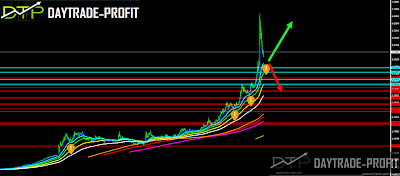

| Turkish lira analysis |

Turkish lira technical analysis

Long-term trend forecast moved is still up as long as 4.80+_ will hold!

Break below 5.31 on weekly basis will send the Turkish to 4.81

a weekly close below 4.81+- will confirm for more down moves.

Break above 5.62 will send the Turkish again to higher levels – below these levels; you need to watch long-term trends mentions above In terms of behavior.

I said that I think the Turkish lira is not expected to recover below 5.31 –next target, if the top will break up again, is standing on 8.36-8.72- we are very close to this level but when I look again on the charts I found that if this case is the same as 2001 to 4.80 price area is can be shown on the charts

Short-term trend forecast: as long as Turkish lira will trade below 5.63 the target is located in 5.45+_ price area with an option to went down over 5.31 +_ price then to 5.13, and or even to 4.80 +_ price

daily closed above 5.63+_ will confirm that the correction is over

|

| Turkish lira chart |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice