Palladium Analysis

Palladium is a component that is related to industrial output and economic output for many industries: Automotive, Technology, Medical Devices and Equipment, and many others.

if palladium price will decrease, it would likely result in a decreasing or weakening global economic outlook and, potentially, be an early warning sign, that the global stock markets are about to enter a period of extended price weakness.

Palladium exploded higher last June, rallying by around 15%, the largest monthly gain across the metals -it a monthly high of $1,568

The transition to renewable and green energies, especially in the transportation sector, led to an increase in the demand for certain metals that were not used anywhere in the past

The lack of deficit or speculation of palladium has caused metal prices to skyrocket in recent months. Could the cost be higher than could be considered reasonable – that is, worldwide adoption and the use of palladium could be stalled?

Although there is a deficit, it is slowly decreasing, and will probably continue to decline as global output is climbing, this may be the opportunity for a long-term decline in demand for palladium, and perhaps even cheaper new developments or alternative palladium products.

|

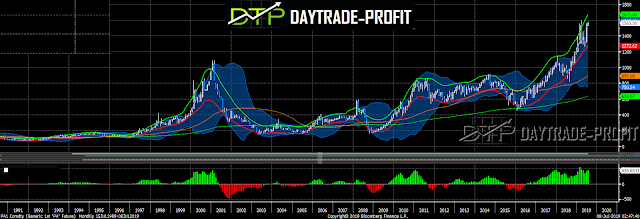

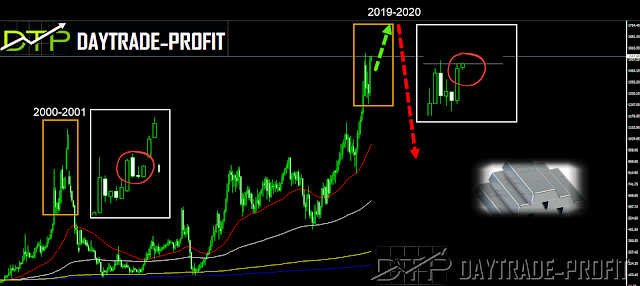

| Palladium chart |

Is this just the beginning of the journey, or we have the creators of the double top pattern

Or maybe it was a replay of 2000-2001 and I just did not look right at the charts?

If this is a double top, then the 1580 area should serve as major resistance, and the metal will not be able to rise above this level – in my opinion, this is not the case

The scenario of continuing the journey up to create a new record followed by a journey down seems to be more feasible

|

| Palladium Analysis |

This review does not include any document and/or file attached to it as advice or recommendation to buy/sell securities and/or other advice