Silver Market Overview – October 28, 2025

Current Price: $45.80

📉 Change: -0.90 (-1.91%)

Institutional Positioning (COT)

CFTC Disaggregated COT Report – Silver (as of Sept 23, 2025)

| Group | Long | Short | Weekly Net Change | Sentiment |

|---|---|---|---|---|

| Managed Money | 51,225 | 14,126 | ▼ -1,327 longs | ✅ Still Bullish |

| Swap Dealers | 25,785 | 69,717 | ▼ Net Short | 🔻 Hedging |

| Other Reportables | 21,093 | 5,916 | ▲ +729 longs | ✅ Bullish |

Total OI: 165,805 contracts

Key takeaway: Strong bullish bias remains from institutional players, but signs of some light profit-taking from managed money last week.

📉 Options Sentiment

🔹 SOF6 (December Expiry – 56 DTE)

- Put/Call OI Ratio: 0.82 → Moderately bullish skew

- OI Clusters:

- $44.00 strike → Over 800 contracts open → Key support zone

- $48–$50 zone → Light resistance from call side OI buildup

🔹 SOZ5 (November Expiry – 27 DTE)

- Put/Call Volume Ratio: 0.45 → Short-term bullish skew (buyers favoring calls)

- Max Pain Zone: ~$44–45

- Current price near OI pivot — lots of gamma-related volatility expected around these levels.

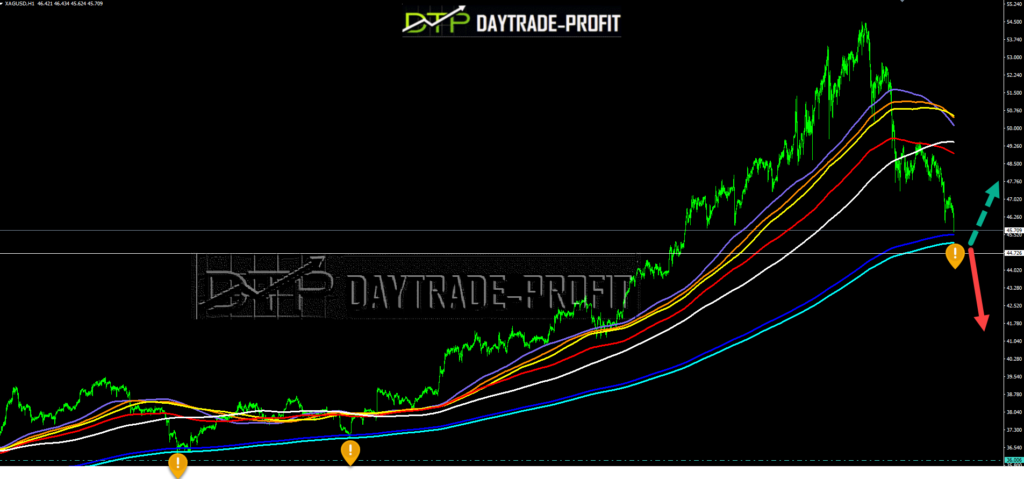

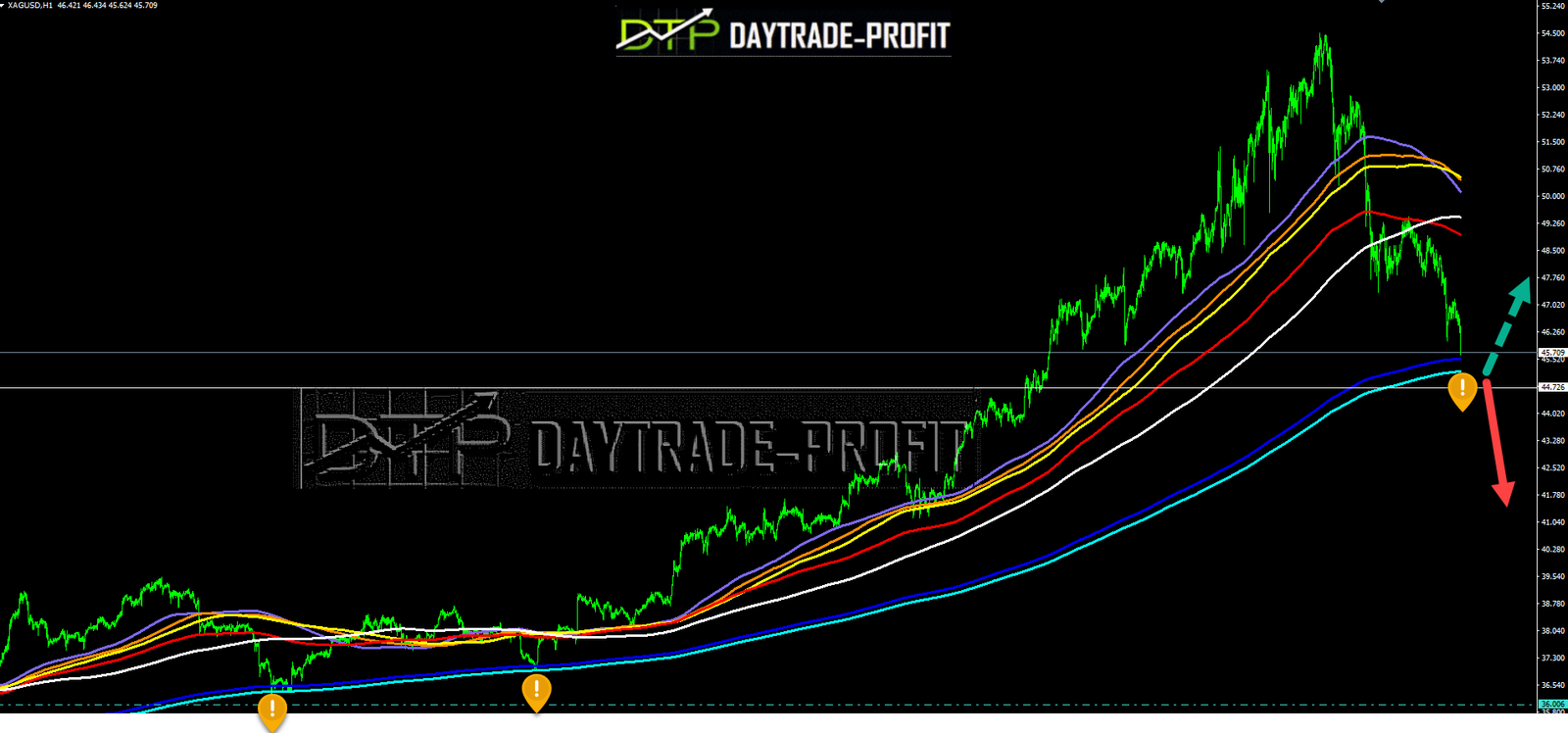

📊 Technical Analysis (Chart-Based)

🔎 Observations from Chart:

- Multi-MA Ribbon Structure

- The price has clearly broken below the medium-term moving average cluster, including the red/gold/purple bands.

- Testing the long-term trend support zone, marked by the blue and cyan bands

- Support Test in Progress

- Horizontal support around $44.10–$45.00 aligns with the long-term moving average and options OI cluster.

- Momentum appears heavy, and the next key support level could be around $43.20 or even $41.80, if selling pressure continues.

- Bearish Momentum Picking Up

- Aggressive volume selling is evident in recent bars.

- If price breaks below $44.10 with volume, further downside toward $42 is likely.

Summary: Full Market Picture

| Component | Bias | Comments |

|---|---|---|

| COT (Institutions) | ✅ Bullish | Still net long, light profit-taking |

| Options OI | 🟢 Moderately Bullish | $44.00 = strong gamma support |

| Technical Chart | ⚠️ Short-term Bearish | Testing critical long-term support |

| Price Action | ❗ Heavy selling | Near-term pressure, bounce or breakdown zone |

Trade Outlook

| Trader Type | Market Action | Strategy |

|---|---|---|

| Swing Trader | Support Test | Wait for confirmation of hold/reversal |

| Trend Follower | Still Uptrend Long | Accumulate at blue-band / $44.10 zone |

| Short-Term Bear | Momentum Favorable | Target $43.20 / $41.80 with tight stops |

| Options Trader | High Gamma Zone | Consider volatility plays or spreads |

📌 Key Levels to Watch

Bullish Invalidation: Break below $43.00 on strong volume

Immediate Support: $44.70 (technical + OI cluster)

Breakdown Target: $43.20 / $41.80

Resistance to Reclaim: $47.50 / $49.00

This review does not include any document and/or file attached to it as advice or recommendation to buy/sell securities and/or other advice