Retail Sentiment brokers dealer and traders who’re the winning

Would you believe there is an edge to be found in analyzing retail trading habits? After all, it’s a known fact that most retail traders are unable to make significant progress. So why would brokers care?

in aggregate, traders were consistently on the wrong side of a trend, that’s something worth using. And it is publicly available information that can help you become a more consistent trader.

Crowd Behavior: The main reason many “experts” and “market forecasters” and the like are constantly wrong is that they pay too much attention to “cold hard facts” and forget that decisions are made based on emotion—on “sentiment”. People consistently fail to read, identify, and filter the overriding sentiment of the majority of people, be it in the markets or in any other occasion.

Instead of having the patience to milk a trend, the majority of aspiring traders fade large moves and are consistently looking to pick tops and bottoms.

The most successful players are not fundamental or technical practitioners; instead, they are traders who can successfully and consistently read people, mood, and sentiment, and they continually fade them. They don’t marry opinions or positions.

Reading and exploiting client sentiment will help you face the right way with your trades, and that is already an edge in itself.

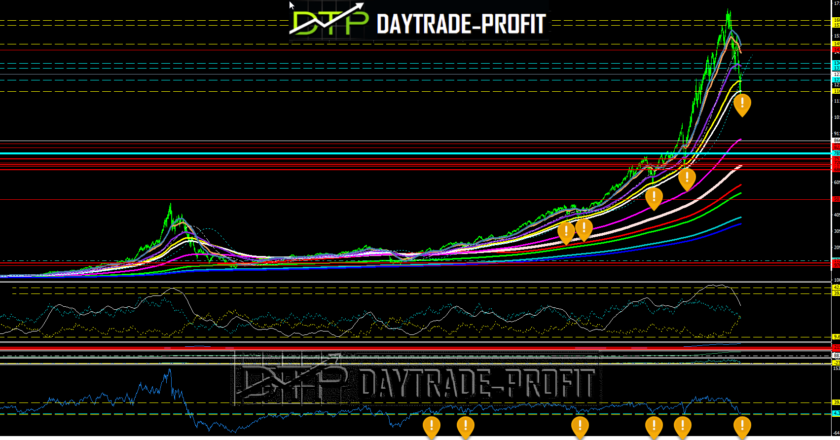

lets take the SP500 for sample – The most tradable contract

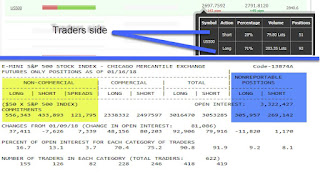

Max short levels was between 2400 -2600 points in sp500 – from 2650 till now we see decrease and even reversal so what’s that mean ….. are we close to the end of this rally or it’s the beginning of the end

|

| markets position |

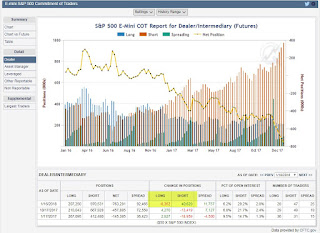

Dealer side – this month for the first time since many months we see increase on shorts position

|

| market cot position |

Why am I telling you all this?

Because I think now is the time to see if it works

The bullish sentiment in the markets is breaking records

The short traders are thrown away at their stops and fuel the rises ,There are almost no sellers.

It’s all honey and raisins … I’m not sure about it at all

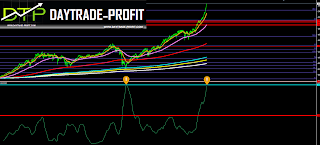

According to the sentiment and the graph, we are on the edge and therefore I think this is the point in which it is worth trying to check whether it will work

I am talking about trading, of course, on the indices when I assume that the markets are in the process of correcting whether I am healthy or not yet know

But patch down almost certainly – with a probability of more than 70%

Lets Build a test strategy

Short position with a stop of 3-4% and profit 7-8%

A ratio of 1: 2 in terms of chance of risk

|

| markets correction |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice

www.daytrade-profit.com