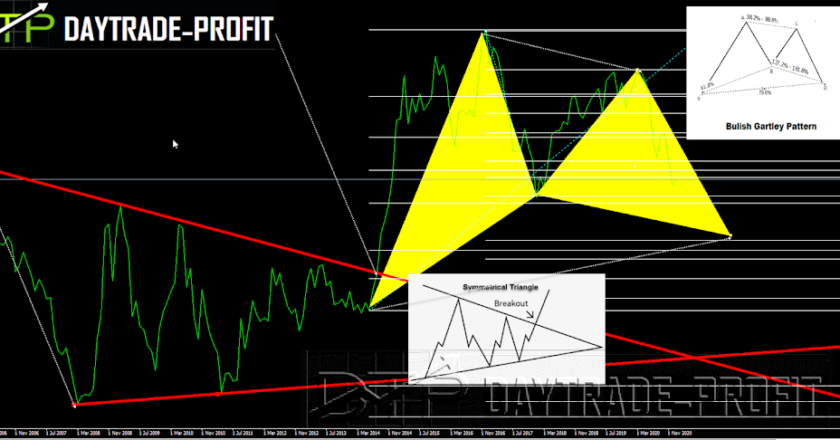

usd price technical forecast update

The dollar index fell below 92 for the first time since January 2015 and finish the day on almost 93 , the index rebounded 0.31 percent and registered 92.911 in late trading. In late New York trading, the euro fell to 1.1514 U.S. dollars from 1.1523 dollars of the previous session, and the British pound dropped to 1.4542 U.S. dollars from 1.4670 dollars. The Australian dollar went down to 0.7487 dollars from 0.7657 dollars. The U.S. dollar bought 106.40 Japanese yen, lower than 106.47 yen of the previous session. The dollar slipped to 0.9533 Swiss francs from 0.9550 Swiss franc and inched up to 1.2724 Canadian dollars from 1.2529 Canadian dollars

Now let’s talk about the numbers: you need to pay attention to 92 levels,

My assessment that the if dollar index will break down 92 so we need to be ready for a further push down to area 89

if 92 will hold then we will get rebound to the area 95-96

|

| dxy |

the US dollar has plunged to a 16-month low in the latest wild move for the global financial system, tightening the currency noose on the euro zone and Japan as they struggle to break out of a debt-deflation trapThe economies of the world: Japan, China, and Europe are in even more disastrous condition. Worse still, their governments and central banks are actually more clueless than Washington and are conducting policies that are flat out lunatic, meaning that their faltering economies will be facing even more destructive punishment from policy makers in the days ahead.

Now let’s get to business and check some pairs:

we see that on all on the majors we got the same structures

|

| pairs |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice