crude oil prices – some interesting information for knowing

crude oil prices down more than 10% from the last record at 66.60 $ , when it will stop?

I’m going to show you some interesting stuff about crude oil prices Later in this article

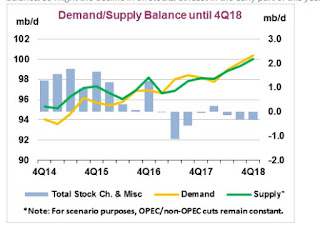

some news comes from IEA:

” The International Energy Agency (IEA) today published their forecast for oil demand growth in 2018 at 1.4 million bpd from a previous projection of 1.3 million bpd. However, the boost in output, particularly in the U.S., will outweigh any growth in demand and increase global oil inventories. The IEA reported, “Today, having cut costs dramatically, U.S. producers are enjoying a second wave of growth so extraordinary that in 2018 their increase in liquids production could equal global demand growth”

|

| crude oil demand |

Crude Oil Technical analysis

After the pattern achieved as I mention the last post- the pattern suggests the bullish trend, for the coming trading sessions, pointing that the prices creating a possible bullish pattern that its confirmation wti level situated at 69 $, from looking at the charts we can see also support at 57 area This pattern also suggests some corrections after reaching the target. Breaking down 57 followed by levels will send the crude oil to cope with 52-54 $l again = strong support!

look on the white strip – you can see clearly the block on the bounder areas

|

| crude oil analysis |

|

| oil analysis |

And for dessert something interesting: Rig Counts

Baker Hughes Rig Counts are published by major newspapers and trade publications, are referred to frequently by journalists, economists, security analysts and government officials, and are included in many industry statistical reports. Because they have been compiled consistently for 70 years, Baker Hughes Rig Counts also are useful in the historical analysis of the industry.

Hughes initiated the monthly international rig count in 1975. The North American rig count is released weekly at noon central time on the last day of the work week. The international rig count is released on the fifth working day of each month.

i checked and compare oil prices to their details see below

|

| oil price forecast |

Based on the data presented, we can see interesting things:

The number of new wells and drillings added according to the price of oil

In the good years of oil in terms of the price of course mainly in 2014 before the big drop in oil prices, you can see that there were an average of 3578 wells

In 2015 the number of wells dropped to 2337 wells when at the peak of the slump in oil prices the quantity stood at 1969 wells when in 2016 the average quantity stood at 1593 wells and the price of oil played between $ 40-50

When the price returned to be firm and relatively stable over $ 50 then the quantity began to rise again gradually

The evidence shows that in 2017 there were 2089 wells

And already in 2018, the quantity continues to rise, suggesting that there is still time for a boom in the sum of well, and inflation in the sum of wells versus oil prices

Let’s say that an average area of 2500 wells is a equilibrium point to address it against oil prices and check where the price is relative to the number of wells

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice