Dollar Index Technical analysis

After The dollar index goes below 90 last month for the first time since November 2014, he made rebound and fell almost 6 % since 2017 December, dollar index price now 89 dollar index which measures the dollar against a basket of currencies

We saw on May 2016 rebound :”After The dollar index fell in 2.5.2016 below 92 this month for the first time since January 2015, he made rebound and jump almost 4 % since then ,dollar index price now 95.15dollar index which measures the dollar against a basket of currencies, rallied to its highest since late March on chances for an interest rate rise soon, “

look on the forex pairs and see their massive move since Dec 2017 -There are pairs that have made a move of more than 6 percent – it’s a lot for such a short period

|

| Dollar index vs forex |

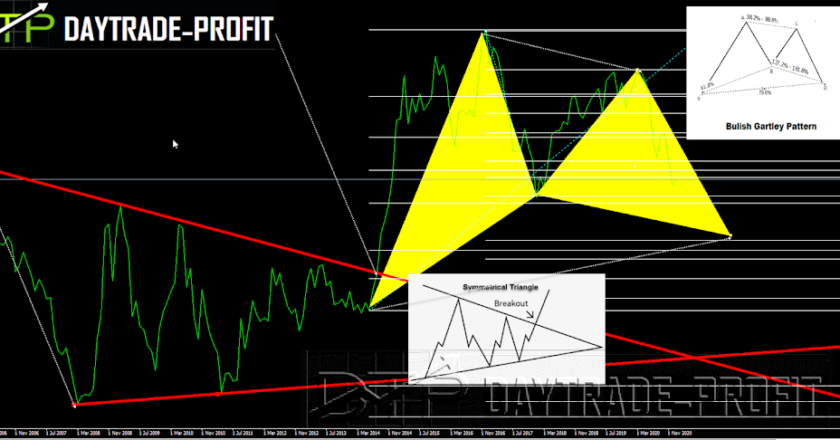

DXY Technical analysis

look on the charts we can see strong support at 89 +_ this level served resistance throughout many years and provided support also, dollar index rate should keep above those level to confirm more upside, fall through could take it to the next support level of 81-82$ ,dollar index rate also is expected to find its first resistance at 92.40-60, and a rise through could take it to the next resistance level of 94, corrections move will probably send the dollar index rate at least to 92.60 area for a test

|

| DXY analysis |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice

1 Comment

Abdul wasay

I am curious to find out what blog platform you are working with? I’m experiencing some small security problems with my latest blog and I would like to find something more safeguarded. Do you have any solutions? usd to jpy