USD JPY Tactıcs That’ll Make You A Better Trader

The jpy has given us strong moves, since late 2012 (80 price level) till the pick in 2015 , In the bigger picture, price actions from high are seen as a corrective pattern

As I told you here and mentions almost 3 times:

“Once again I turn your’s attention to 1998-1999

Note the charts: If the photo is indeed the same, then it is fitting for

Continued increases in the usdjpy, move into a similar facility.”

|

| usd jpy technıcal analysıs |

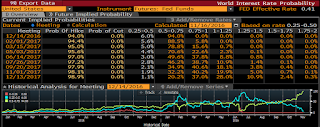

USD/JPY is currently trading with an increasing bullish momentum, the US Dollar rally push him to the sky, it’s because a lot of reasons: 90% probability Fed raises rates in December more than 90% , and signals two more hikes next year election of Donald Trump, doing good to the dollar, followed his remarks, the dissatisfaction, low interest rate market, Trump’s economic policy is also regarded as likely to boost fiscal stimulus and spur inflation, and that has sparked a sell-off in U.S. Treasuries. The 10-year yield fell two basis points to 2.20 percent on Thursday, after touching 2.30 percent earlier this week, its highest since Dec. 31

|

| jpy rate |

From the technical view: we can few things: In the bigger picture, price actions from high are seen as a corrective pattern – for those of you, who stay in positions, the direction now is up with the momentum, but you should pay attention to 113-114-115 – those levels are extremely vulnerability

In the short term we can see the corrective move from the lows, as long as usdjpy will stay above 104.80-105.30 the direction is up, while in the middle we have 106.20-70 area

Strong support at 101.80

If the situation is the same as 1998-1999 we should expect to see the usdjpy doing the same moves – lower than 98 levels, only crossing up and break 116.80 area level will confirm the movement has changed again

|

| usd jpy chart |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice