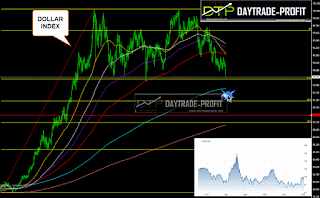

Dollar index price forecast

We saw and still see the steps the Age of reducing interest rates and the money printing

At the same time that the United States did so in the end the crisis, other countries sat waiting

And today: The US is facing rate increases while others only “remembered” to the United States made a long time ago

from my last post on the us dollar

|

| DX |

While strategists at Bloomberg are idealistic about the dollars proceeded with quality in the coming years, our investigation of five separate information focuses recounts an altogether different story.

The five information point sign is the U.S. Dollar Index, a file that measures the execution of the dollar against a wicker bin of five monetary standards – the Euro, Japanese yen, Swiss franc, Canadian dollar and Australian dollar.

Post-U.S. monetary emergency of 2008, King Dollar had huge increases against this five coinage. The most reduced addition was against the Canadian dollar at almost 15% from topping at January this year, with the ascent beginning in 2014. Additionally with the ascent dating from 2014, the U.S. dollar increased 24% against the Euro.

In 2011 the USD began its ascent against the Canadian dollar and Swiss franc. The dollar went ahead increases of 35%, 32%.

The previous six months have not been thoughtful to the dollars’ worth against the cash wicker container. To be clear, the dollar still stays solid and, meanwhile, in any event, it will keep on being above all else.

Be that as it may, chinks in the dollar’s protection have shown up, in the previous six months, the USD has declined against every one of the five of this coinage.

From a low in the scope of a 5-7% pullback against the pound, Canadian dollar, Euro, and Swiss franc since the individual highs to a 10% and 12% decrease against the yen, separately, the USD has a down pattern ,as long as usd remains below 96.50 the trend is down.

Now let’s talk about the numbers: you need to pay attention to 92 levels,

My assessment that the if dollar index will break down 92 so we need to be ready for a further push down to area 89

if 92 will hold then we will get rebound to the area 95-96

|

| DXY |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice