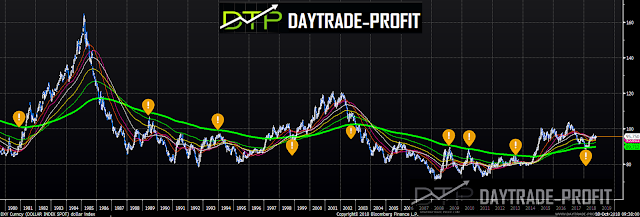

Dollar Index analysis

US Dollar’s long-term outlook looks bullish

Its look like U.S. economic recession is likely to start in 2019 or 2020 as I wrote a few times to watch the behavior in 1998-1999 in the forex market and equity market (a similar case for my opinion)

DXY – US Dollar look is approaching the topside of its recent near five months consolidation

|

| Dollar Index |

US dollar keeps the upside unabated so far after the FOMC remained on hold on last rate decision, as largely expected. However, the Fed’s statement highlighted the positive momentum of the economic growth and noted that inflation tracked by the PCE is closer to the Fed’s target.

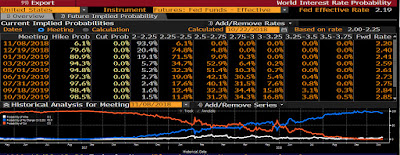

Currently, Fed funds futures are pricing in a 75% chance of a 25-bps rate hike in December.

|

| USD RATE |

in fact today we can see other countries are much weaker than the U.S.

In other regions like the EU, China, and other emerging markets are barely limping along while the U.S. economy is on fire, imagine how much worse they will be when the U.S. itself falls into a recession.

There are more significant that the next recession will be much worse than the U.S. This supports the case for a rising USD in the next recession.

When other countries deteriorate at a much faster rate than the U.S. in the next recession, the U.S. is relatively better off. As a result, the USD will rise vs other currencies.

Some effects have a large impact on USD dollar: they came from the trade war with China – there has been a bit of negativity abroad, In addition, yields of the key US 10-year reference have retaken the psychological 3.00% handle, also collaborating with the sentiment around us dollar.

|

| Dollar Index analysis |

This review does not include any document and/or file attached to it as an advice or recommendation to buy/sell securities and/or other advice