Markets Overview and Risk Assets

The last post was: Are we seeing the high for the short-medium period?

Also in May, I wrote: Does the economic situation of the stock market combined with the bond markets reflect the real problem

The question is whether what we saw from the bottom in 2020 is just the trailer for the future to come in the markets:

It’s hard to know exactly what will happen, no one can predict

What matters right now is the expectation of the interest rate for the future

The interest rate is currently the catalyst for the main moves

The bright spot that can be seen positively about the future embodied in the markets, is in the pricing of the currencies and gold that will probably affect the stock markets

Exchange rates reflect the state of the markets and broader economic conditions in several ways. Exchange rates are the relative values of one currency compared to another, and they are determined by various factors, including supply and demand dynamics in the foreign exchange market. Here’s how exchange rates can reflect the state of the markets:

Interest Rates: Central banks’ decisions regarding interest rates can significantly impact exchange rates. When a central bank raises interest rates, it can attract foreign capital seeking higher returns, leading to an appreciation of the currency. Conversely, lower interest rates can result in currency depreciation.

Market Sentiment: Market sentiment and risk appetite also play a role. In times of uncertainty or heightened risk aversion, investors often flock to safe-haven currencies like the U.S. dollar, Swiss franc, or Japanese yen, leading to their appreciation.

Central Bank Interventions: Central banks may intervene in currency markets to stabilize or influence their currencies. For example, a central bank might sell its own currency to prevent excessive appreciation or purchase its currency to prevent depreciation.

Relative Strength of Other Currencies: Exchange rates are always comparable. The value of one currency is expressed in terms of another. Therefore, changes in the strength or weakness of other major currencies can influence exchange rates.

spoiler: next week predict something interesting in the markets

There is a paradox – if we look at the exchange rates of the currencies against the dollar

Today, while interest rates stay at 5.5% in the US, it can be seen that the exchange rates of the yen and the euro do not directly reflect the strengthening of the dollar

It should be that at the same time, there is an increase in interest rates on the USD the others went down

Yen dollar stood at rate zones of +151, while the interest rate in the USA stood at 3.00%

The Euro-Dollar rate stood at 0.95 +- while the interest rate in the USA stood at 3.00%

Gold traded in the 1600 area while the interest rate in the USA was at 3.00%

It is true that some will say that then the outlook looked more gloomy and therefore we saw this weakness, but still in a realistic and future view it is not directly related to today’s situation

Today the interest rate is at 5.5%, not only are they not trading below, but the price is at higher numbers against the dollar – which reflects that the future does not look so rosy for the dollar, or that the interest rate hikes will not continue, or the final option is that the numbers are lying

time will tell ……

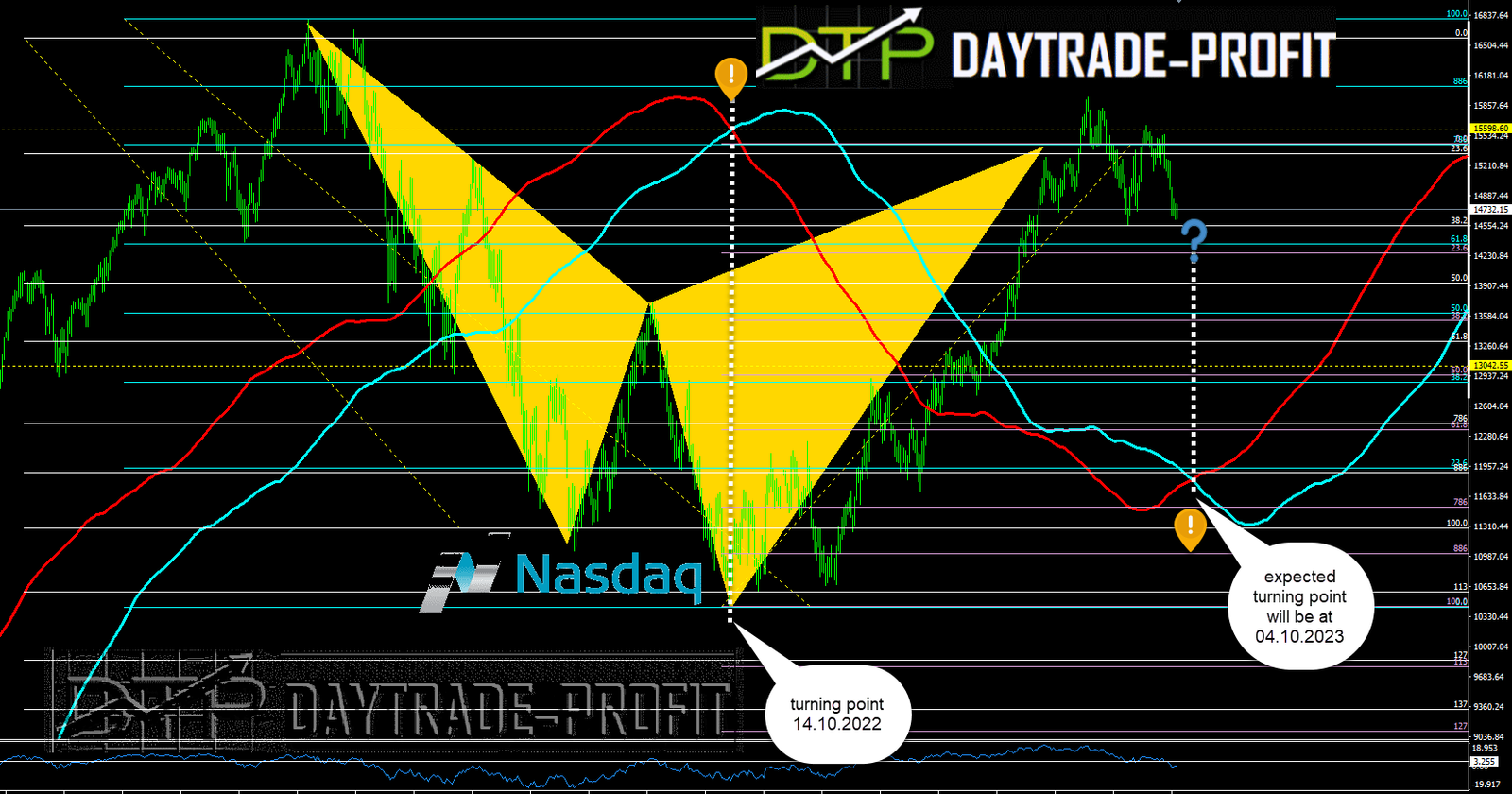

Now let’s go to the charts – first, let’s check the NASDAQ

Technical analysis for the NASDAQ:

Correction approved will take place when we will be closed daily below 14630+_

short support areas: 14200,13400,12600

An open gap at 13700-13800

From above Resistance level areas stay at 14,800-14,930

14,600 area last lows – (Correction approved will take place when we will be closed daily below 14630+_)

Below those level as mentioned above – the target point stay at 14200-144400

main support zone at 13,900+-

Technical analysis for the S&P 500:

Short support areas: 4200+

From above Resistance level areas stay at 4320-4360

4320 area last lows – (Correction approved will take place when we will be closed daily below 4320+)

Below those level as mentioned above – the target point stay at 4100-4200

main support zone at 4100

This review does not include any document and/or file attached to it as advice or recommendation to buy/sell securities and/or other advice