Gold Overextension & Seasonality: What 1980, 1983, and 2026 Have in Common (and What They Don’t)

Gold doesn’t just “trend.” At extremes, it becomes overextended—and then it either mean-reverts hard (classic blow-off) or cools off sideways (normalization). This post lays out a practical, data-driven framework for reading those regimes, anchored on January–February behavior in 1980, 1983, and 2026, and tied to the macro triggers that typically decide whether an overextension becomes a top or simply a pause.

Context (Jan 21, 2026): gold pushed to fresh nominal records above $4,800/oz, fueled by a fast shift into safe-havens amid geopolitical tension and tariff/trade-war risk, alongside a weaker U.S. dollar and changing rate expectations.

Key takeaways (TL;DR)

- Overextension (e.g., >30% above a long-term moving average) often marks a fragile zone where small macro changes can trigger sharp pullbacks.

- 1980 looks like a textbook blow-off: inflation/fear + speculative heat → policy tightening → reversal.

- 1983 looks like normalization: cooling inflation + higher real rates → range or soft drift down.

- 2026 is overextended too, but the engine is different: geopolitics/trade risk + safe-haven demand + policy expectations, with official-sector demand and ETF flows as structural supports.

- The “next move” usually depends on real yields, policy expectations, USD trend, and flows (central banks + ETFs).

The framework: “Overextension regime” vs. “Normal trend”

What “overextended” means (simple definition)

A clean working definition:

Overextension = price is >30% above a long-term moving average (often the 200-day MA for daily charts).

Why it matters: the farther price stretches above its baseline trend, the more the market tends to become sensitive to:

- changes in real yields (opportunity cost of holding a non-yielding asset),

- shifts in risk sentiment,

- and policy messaging (cuts vs. “higher for longer”).

Practical note: Overextension doesn’t automatically mean “top.” It means asymmetry: upside can continue, but drawdown risk rises.

1) 1980 vs. 1983: the archetype (blow-off → normalization)

1980: the peak template

January 1980 is one of the most cited “gold climax” episodes for a reason: the London gold price fix hit $850/oz on Jan 21, 1980, a record widely referenced in industry histories.

What tends to define a blow-off:

- rapid acceleration,

- narrative dominance (inflation + fear),

- positioning crowding,

- then a macro “pin” (often tighter policy / rising real rates).

A key piece of that pin: in the Volcker era, restrictive policy drove the federal funds rate to a record ~20% in late 1980, sharply raising the opportunity cost of holding gold.

1983: why it didn’t “re-bubble”

By 1983, the macro backdrop looked less like crisis climax and more like stabilization:

- inflation had cooled materially from its peak (the Fed’s historical overview notes inflation reached more than 14% in 1980 before later declining),

- real-rate competition mattered again (cash/yield became attractive relative to gold).

Read: 1980 = blow-off dynamics; 1983 = normalization dynamics.

2) Seasonality inside overextensions: why January–February matters

Rather than generic “gold seasonality,” the useful lens is:

Seasonality during an overextension regime (when price is already stretched).

What the Jan–Feb paths often look like

- Jan–Feb 1980: parabolic surge → reversal (classic climax behavior).

- Jan–Feb 1983: sideways-to-down (cooling regime; yield competition).

- Jan–Feb 2026 (to date): strong expansion with elevated volatility (safe-haven bid + trade risk premium).

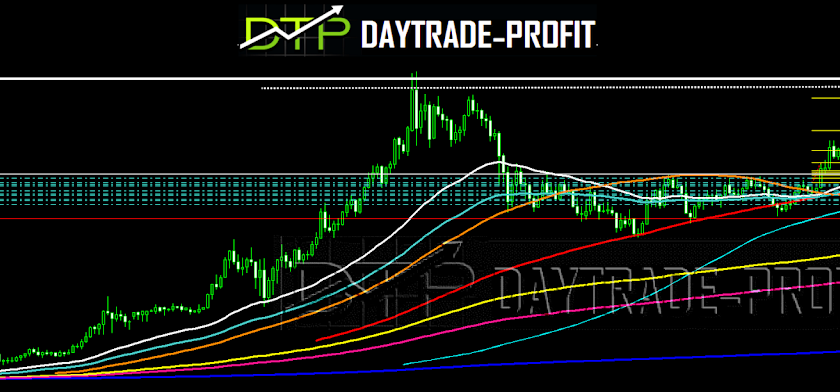

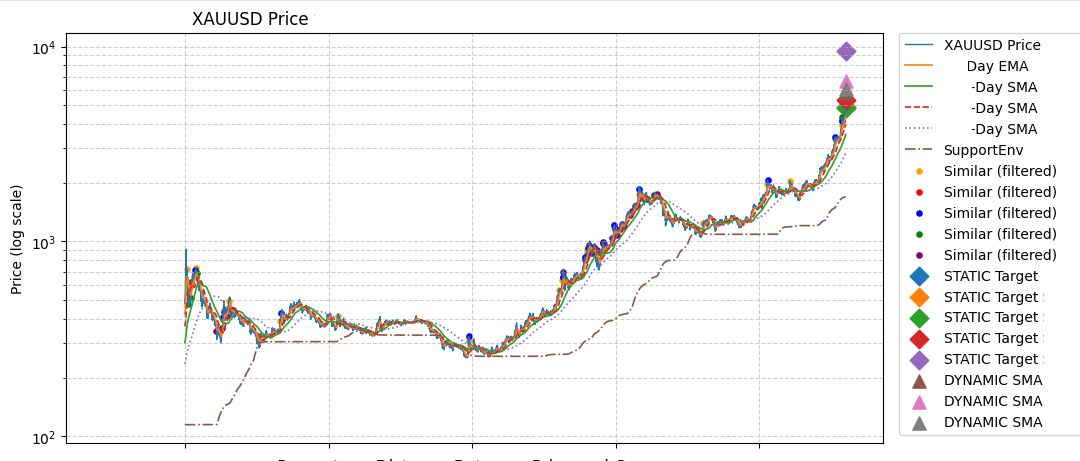

Charts that make this “feel real” (high-SEO, high-retention)

If you add only three visuals, make them these:

3) 2026: overextended, but driven by a different engine

In mid-January 2026, multiple reports tied gold’s record run to:

- heightened geopolitical tension and trade/tariff threats,

- a weaker dollar,

- and shifting rate expectations—boosting demand for safe-haven assets.

The structural “floor” argument: flows matter

Two flow channels are consistently cited as support:

- Central bank demand has remained elevated in recent quarters.

- Gold ETFs saw exceptionally strong inflows in 2025, with the World Gold Council describing 2025 as the strongest year of inflows on record.

Translation: flows don’t prevent corrections—but they can change their shape (shallower dips, faster rebounds, higher volatility).

4) What happens after an overextension? Probabilities by analog (not predictions)

These are conditional probabilities—meant to frame outcomes, not call the market.

1980 analog: high mean-reversion risk (2–6 months)

When overextension coincides with tightening and rising real-rate expectations, pullback odds often rise. The early-1980 policy shock (including the funds rate peak) illustrates that mechanism clearly.

Heuristic: once you get a climax-like move, the base case often shifts toward correction risk.

1983 analog: range-bound to mild downside

In normalization regimes:

- inflation pressures are cooling,

- real yields compete,

- gold often drifts or ranges rather than exploding upward.

2026 (current regime): bullish bias, but drawdown risk is real

A reasonable regime-weighting framework looks like:

- Continued bullish regime: ~45–55%

- Mean reversion correction: ~30–40%

- Flat/sideways: ~10–25%

Key point: 2026 can remain bullish and still deliver fast, ugly pullbacks when stretched.

5) Major overextension “rhymes”: 1980, 2011, 2026

Overextensions tend to rhyme in structure:

- acceleration

- narrative dominance

- later-stage divergence risk (momentum strong while trend measures lag)

- 1980: inflation/fear climax + tightening shock → multi-year unwind template.

- 2011: crisis-era safe-haven peak → prolonged correction once stress normalized (classic “fear bid then fade”).

- 2026: geopolitics/trade premium + safe-haven demand driving record pricing in current coverage.

6) Example model bands (scenario levels, not certainties)

If you’re using scenario bands (like your current setup), presenting them as ranges helps readers avoid “single-number thinking.”

| Scenario | Level | Notes |

|---|---|---|

| Median direction | Up | Baseline bias |

| Bull base target (121-day median) | 5334.57 (~+10.2%) | Upside scenario band |

| Pullback zone | 4498.31 (2026-01-19) (~-7.1%) | Mean-reversion area |

| Bearish tail (95% lower bound) | 4115.72 (2026-01-21) (~-15.0%) | Downside tail risk |

| Bullish tail (upper bound) | 6280.15 (2026-07-06) (~+29.7%) | Upside tail case |

How to read it: constructive bias, wide distribution—exactly what you’d expect in a geopolitically driven, overextended tape.

7) The macro triggers that usually decide the path

If you want a practical dashboard, watch the variables that directly impact gold’s opportunity cost and safe-haven demand:

- Real yields trend (rising real yields often increase mean-reversion pressure)

- Policy expectations (cuts vs sticky inflation / higher-for-longer)

- USD trend (a weaker dollar often supports gold)

- Geopolitical escalation / trade regime risk (safe-haven bid strength)

- Flows

- central banks (structural bid)

- ETFs (fast sentiment gauge)

FAQs (good for SEO + featured snippets)

Is gold “overbought” when it’s 30% above the 200-day moving average?

It often signals overextension—a stretched condition where pullback risk rises. It’s not a guaranteed top; it’s a risk regime.

Does gold have reliable seasonality?

Gold seasonality exists, but it’s most useful inside regimes. Overextended markets can ignore normal seasonality until a macro trigger hits.

What happened after gold’s 1980 peak?

After the January 1980 climax (including the $850 London fix), tighter policy and higher rates increased opportunity cost, contributing to a major unwind template.

Is 2026 more like 1980 or 1983?

Catalyst-wise, it’s different from 1980 (today’s driver is more geopolitics/trade risk than a pure inflation shock). Structure-wise, both share overextension risk—meaning sharp pullbacks can still happen even in a bull regime.

Conclusion: what 1980, 1983, and 2026 really teach

The common thread isn’t “gold always crashes after a big move.” It’s this:

When gold is materially overextended, macro triggers matter more than charts.

- If real yields rise and risk appetite returns → mean reversion becomes more likely.

- If geopolitics stays hot and policy expectations lean dovish → upside continuation stays live.

- If flows (central banks + ETFs) remain strong → pullbacks may be sharp but often get “caught” faster.