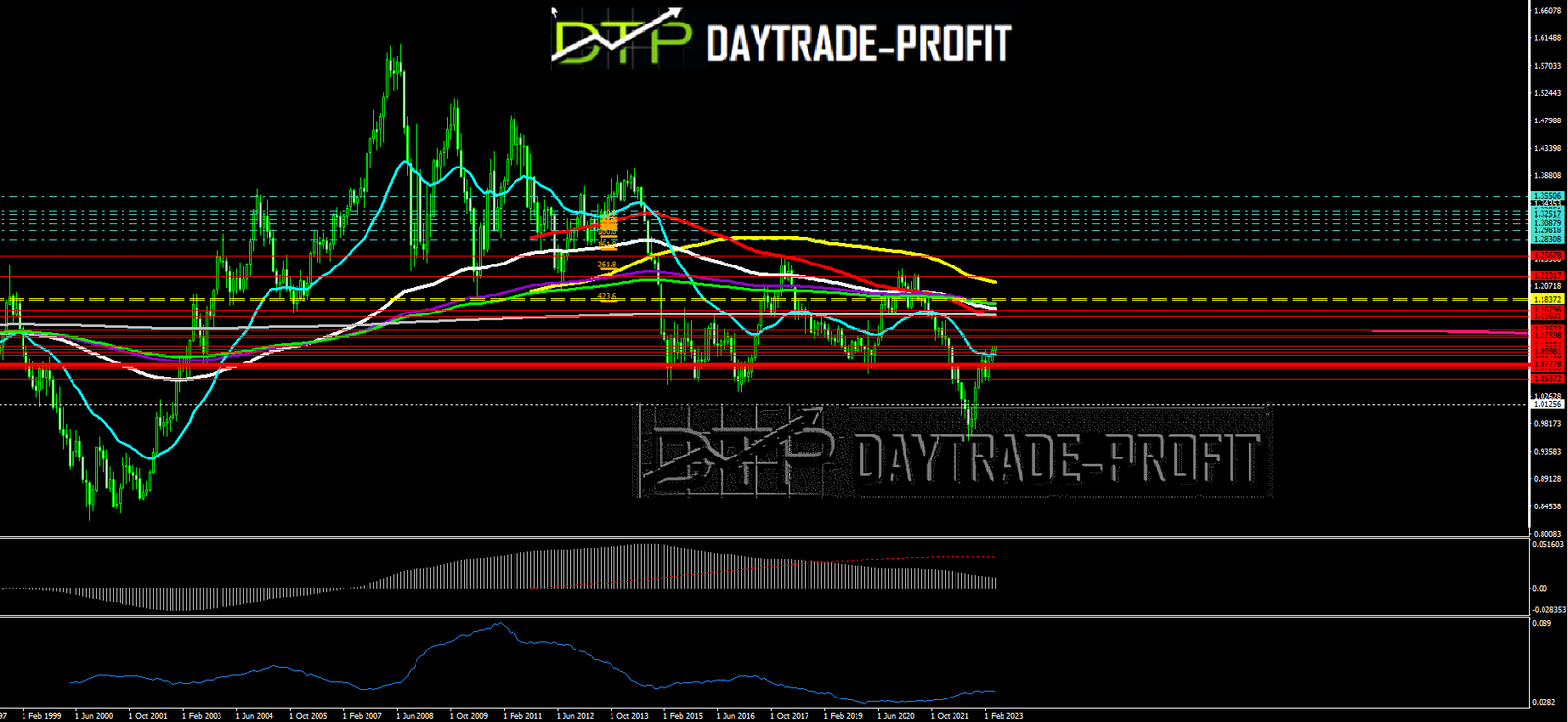

EUR/USD Technical analysis

The technical outlook for EUR/USD depends on the timeframe being considered. In the short term, the pair may experience some volatility as traders respond to changes in market sentiment and economic data releases – we may see a very fast move towards 1.1180 1.1230 resistance and even to 1.1340 -1.1370 when the pair break above 1.1090 on daily basis

On the daily chart, the EUR/USD pair has been trending lower since early 2021, forming a series of lower highs and lower lows. The pair has also broken below key support levels, including the 1.2000 and 1.1800 levels, indicating a bearish bias.

The pair is currently trading above 1.0940, which could provide some support, but if the pair breaks below this level, it could lead to a further decline.

Overall, the technical outlook for the EUR/USD pair suggests that traders and investors should be cautious and watch for any potential reversal or bullish signals. Any significant break above key resistance levels, such as the 1.2100 level, could indicate a shift in sentiment and a potential reversal of the bearish trend

This review does not include any document and/or file attached to it as advice or recommendation to buy/sell securities and/or other advice