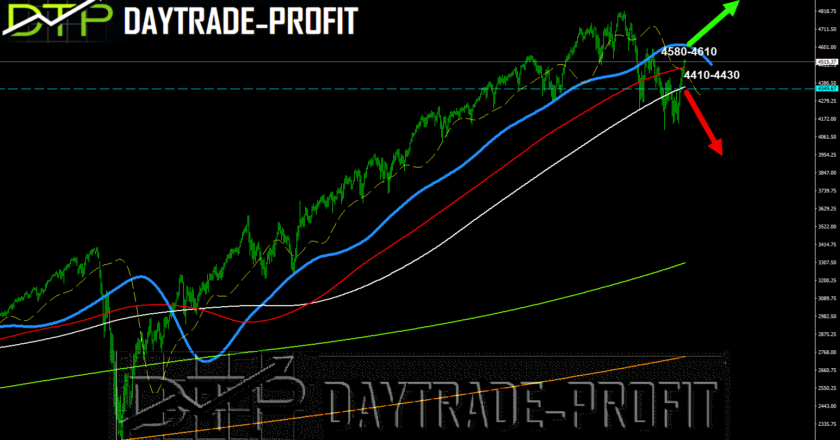

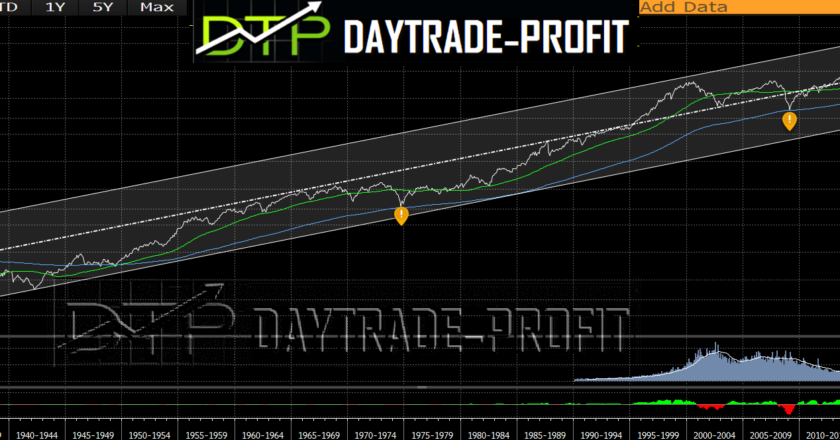

The SP500 index appears to be entering a critical phase. Current projections indicate a potential decline to the 5500-5600 range, reflecting a natural market correction or consolidation. However, this move should not be viewed purely as a bearish signal. Instead, it may act as a setup for a significant upward wave, akin to the explosive rally seen during the mid-1990s…