Crude oil Check status and review factors

Oil is crashing – The marks were on the wall

crude oil showing suspicious signs

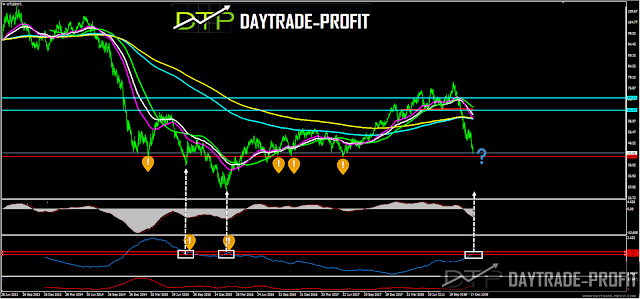

Is there a negative deviation between the oil price and the technical parameters on the charts?

Two months were enough to erase two-year profits

More than 40% decline in price in such a short time

Something not seen in the markets

Oil is a highly sensitive indicator relative to the expansion or contraction of the economy. it is not surprising that sharp declines in oil prices have been coincident with downturns in economic activity

The supply-demand problem is not likely to be resolved over the course of a few months either, Even if OPEC does continue to reduce output, it will continue to be insufficient to offset the increases from oil field production.

In my opinion, we are close to equilibrium due to several factors

Production costs – Today the cost stands at $ 43 per barrel – no one wants to sell at a loss

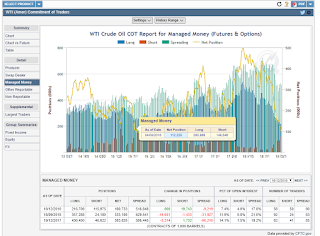

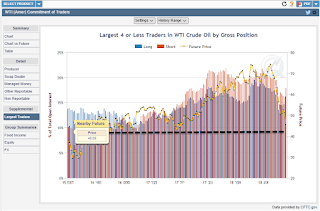

Key player positions and Oil producers

Technical price analysis

|

| crude oil position |

|

|

|

The fact that the violence we see in the financial markets also contributes to the negative trend, and if it continues like that, then for a short period, the price can continue down without referring to the factors

Technically you can see that Area 42$ is saturated with signals and strong support points

If the price is not supported in the 41.30-41.80 area then I will have no choice but to continue diving down towards $ 34

Therefore anyone who is looking to do a trade-repair should pay attention Those points

|

| crude oil analysis |

This review does not include any document and/or file attached to it as an advice or recommendation to buy/sell securities and/or other advice