Dollar Index analysis

DXY – US Dollar is approaching the topside of its recent near three months consolidation

US dollar keeps the upside unabated so far after the FOMC remained on hold on last rate decision, as largely expected. However, the Fed’s statement highlighted the positive momentum of the economic growth and noted that inflation tracked by the PCE is closer to the Fed’s target.

Currently, Fed funds futures are pricing in a 90% chance of a 25-bps rate hike in September and a 65% chance of a hike in December. A week ago, odds were closer to 80% and 60% for September and December, respectively.

some effects on us dollar came from the trade war with China – there has been a bit of negativity abroad, In addition, yields of the key US 10-year reference have retaken the psychological 3.00% handle, also collaborating with the sentiment around the buck.

Break up 95.80 price level will confirm for more up

|

| DXY ANALYSIS |

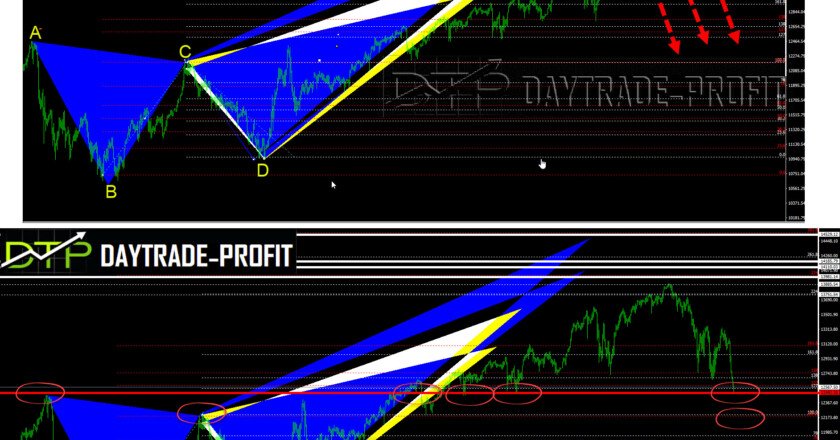

INVERTED HEAD AND SHOULDERS PATTERN

Head and Shoulders Bottom sometimes look as s a major reversal pattern, basically, the two shoulders would be equal in height and width. The reaction highs in the middle of the pattern can be connected to form resistance or a neckline.-for approved high numbers target need more heavily on volume patterns for confirmation

Break up 95.80 price level will confirm for more up

Going back again to test 91.80+- price area can create a good condition for building this pattern

|

| Dollar index |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice

1 Comment

Sujitha

Excellent Post. I just bookmarked your blog and I have really enjoyed reading your blog posts. Stocks Hit 52-Week Low On NSE Visit our website for more stocks related information.Thanks

SBI Card IPO Subscription Details

Foreign Exchange Market

Foreign Exchange Market