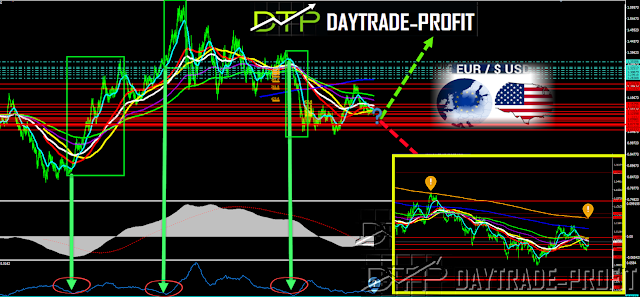

EUR USD TECHNICAL ANALYSIS

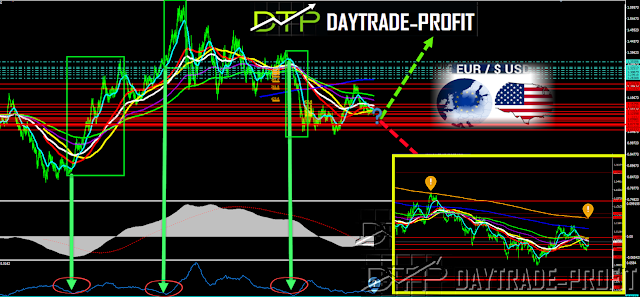

last week EUR/USD recovered to 1.1050.

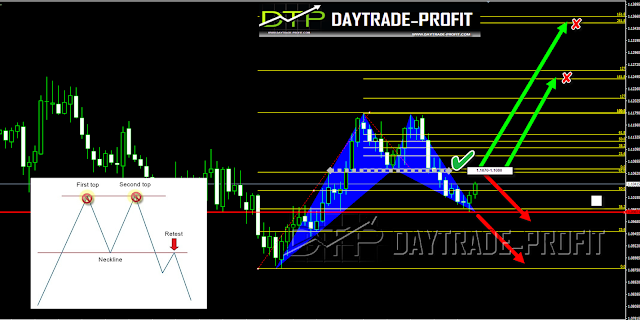

M pattern could be in place – more decline is expected as long as 1.1080+_ resistance holds. Corrective rebound from 1.0879 should have completed at 1.1230+_ .

The bullish potential is limited by technical indicators

short term optimistic: in the other hand, The confirmation of the closing price reversal bottom is potentially bullish. Typically, this chart pattern leads to see some rally trend. Its first upside target to check 1.1080+_ , closing up above this price will mark new high targets.

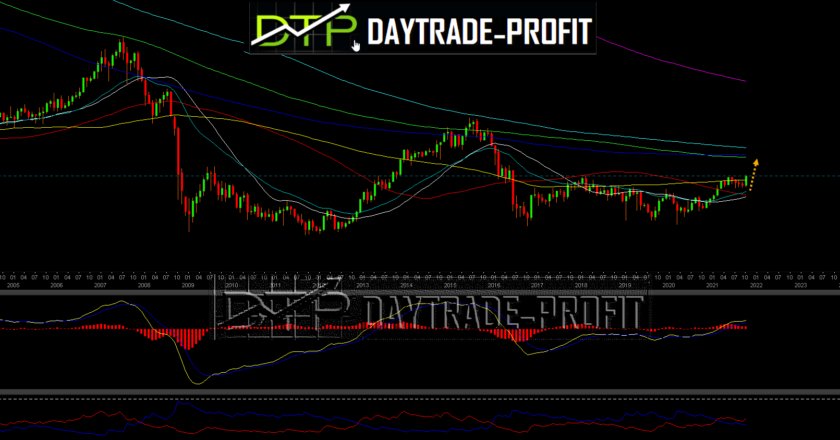

In the long-term picture, the outlook remains bearish for EUR/USD as long as he trades below the long trend line in 1.16.

|

| EUR USD Technical analysis |

EUR USD TECHNICAL ANALYSIS:

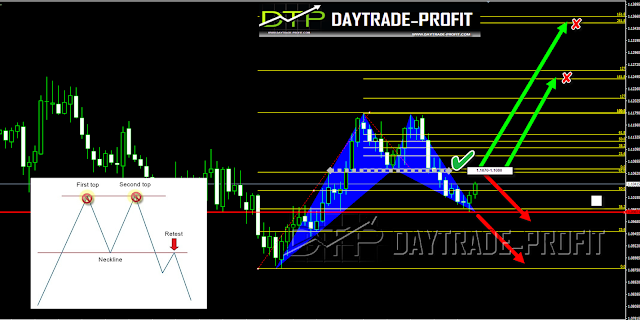

Double top chart pattern or Or kind of Bullish Gartley Pattern?

are we have a double top formed on the EUR USD. Notice that we have a well-defined neckline support level as well as a subtle “M” shape that has been carved out as a result.

in this scenario, we would have waited for the market to break or crack the neckline in 1.180+_

you should Notice how the EUR USD currency pair reacting after retesting the neckline.

A measured move objective can be used to find a potential profit target. To find this you simply take the distance from the double top-up the resistance level to the bottom and extend that same distance beyond the neckline to a future, lower point in the market- in this case, its equal to 300+_ pips = 1.0560-70+_

On the other hand, a breach of the 1.1080 area has been established from above

Give the EUR USD fuel for further increases to the 1.1230 area and perhaps even more to the 1.1350 region

|

| EUR USD analysis |

This review does not include any document and/or file attached to it as advice or recommendation to buy/sell securities and/or other advice

www.daytrade-profit.com