2 facts about eurusd that will improve your trading

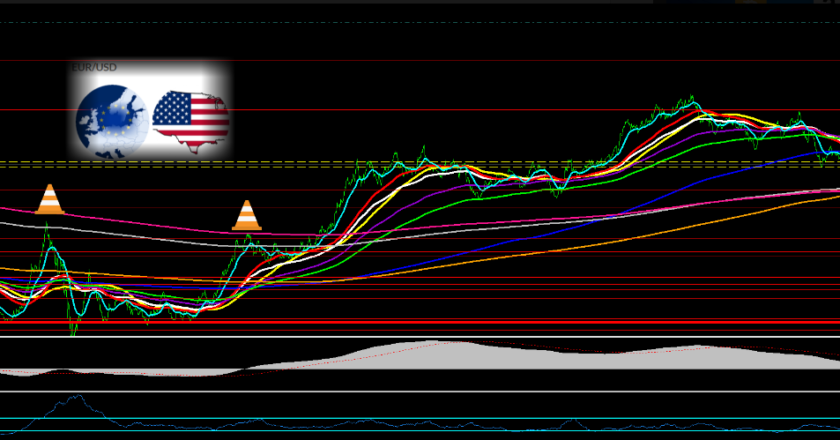

eurusd was pushed lower after failure to break above 1.1460 level

In the long term, a projection target stay under 1.00, proving that a bearish breakdown of the monthly demand level at 1.0550 occurs.

Multiple ascending bottoms were established around the levels of 1.0460, 1.0550, 1.0640 ,1.0720-80 ,1.0820-90. These levels corresponded to the daily uptrend depicted on the chart.

From closer look we can notice 2 pattern that emergent

The first one is the Harmonic Bat Pattern: target stay at 1.0640-70 level

This is one of the retracement patterns, and is a deep retest of Support This pattern usually has an extended CD leg which is 1.27 Fibonacci extension of the AB – providing a favorable risk/reward.

The second is the Harmonic Crab Pattern: tartternget stay under 1.000 at 0.98

This pattern is the tight Potential Reversal Zone created by the 1.618 of the XA leg, AB leg can retrace anywhere between 38.2% up to 61.8%, CD is an extension of up to 161.8% of XA leg

|

| eurusd |

|

| euro |

This reviewdoes not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice