Gold Price Analysis

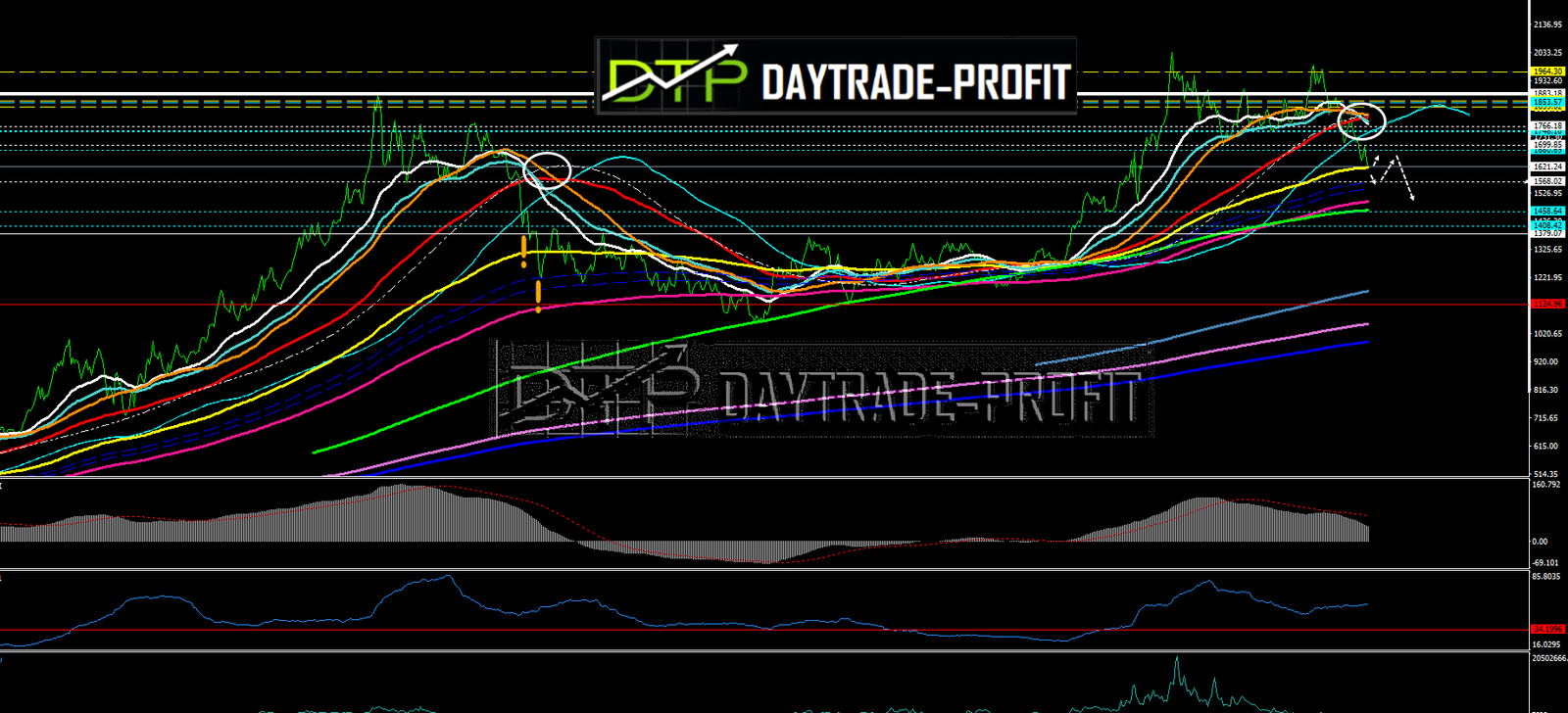

The gold continues to resemble past moves back in 2021, in the month of August, “Has the affirmative rise in gold ended and the great decline in gold is before us”? I mentioned the future to occur in the movement of gold

Last August we received an overwhelming confirmation of the move – check the last pot

Now I see 2 possible scenarios according to the downward trend and compared to past moves and their configuration, I marked them on the graph with exclamation marks in the previous actions and white arrows in the current move

The first option is continued declines from the last low

In terms of bands and price, a drop below the 1610 area, the last low we saw on 28.9, will lead in the first stage to the 1580-1590 area.

A break of the 1580-1590 zones will send gold to face lower levels 1560-1570 with an option to the 1540 zone

The second option is a temporary stop and support at the level of the last low

In terms of bands and price, 1610+_ which is the last low we saw on 9/28 will lead to a correction to the 1670-1690 area

In the areas of 1670-1690, we will get a rooftop that will send gold to deal with the lower levels mentioned in the first option

long term I am waiting for this:

gold forecast

This review does not include any document and/or file attached to it as advice or recommendation to buy/sell securities and/or other advice