The Unconventional Guide to Gold

Gold ( xauusd ) struggle to stay above 1350+_ area , It closed almost on lowest point of the week at 1335$ .

As I post on my last article

From Bloomberg “Middle East jewelry demand declined 22 percent to 45 metric tons, with Egypt down 40 percent to 5.3 tons, the lowest on record, the World Gold Council said in a report on its website Thursday. In Turkey, first-half investment demand for coins and bars was 8.8 tons, the lowest since WGC records began in 2000.

Gold consumption in China and India, the world’s top two buyers, is set to drop 15 to 20 per cent in 2016 after lower investment demand and jewelry sales, an official at a leading importing bank said.”

Lower demand from the two countries, which account for more than half of the global market, could limit a rally in global prices which are trading near a two-year high.

“Indian demand would be 15 to 20 per cent lower in 2016 than the previous year. Higher prices, weak investment demand contributed in reducing consumption “, India is not unusual. This is a general trend across Asia

Now Let’s see the GLD SPDR ( SPDR® Gold Shares is the largest physically backed gold exchange-traded fund (ETF) in the world)

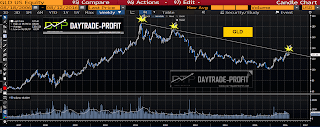

From technical view we can see the obstacle we find is the Down trend line (on a linear scale) starting at the 2011 highs and connecting the October 2012 highs. Extending that trend line to the present places it at approximately 130. Today’s high before the pullback was 129.26, also there is an open gap on 120-121 area with mention the last time we saw this price, there was a big VOL there, so I’m expected to see that that level again- break there isn’t good sign for gold holders.

|

| GLD SPDR |

|

| GLD |

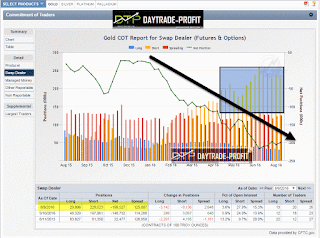

COT state positions: we can see the high number in short position, it could lead to test again the 1180$ price level

|

| gold COT |

Technical analysis:

As long as gold xau/usd stay and trade below 1352+_ the trend became bearish, I’m expecting to meet 1333 1326 1315 areas – break down 1315 level will lead the gold to 1294-1304 point, then it could go to 1247-1256, while we need to watch at 1268-1274 area.

while break above we lead above 1400$ price area .

Strong support: 1224-1233 price areas are meaningful numbers

|

| gold technical analysis |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice