MARKETS FORECAST UPDATE FOR 2017

A fairy tale as parable

Once upon a time there was a terrible monster,

On Sunday, she would eat a thousand Red Short traders

On Monday, she was eating a green salad at Mount Kilimanjaro.

On Tuesday, she would swallow more green tea than the days of the green ocean and the blue ocean combined.

On Wednesday, she would eat a nectar after cooking it well in an option on the fire.

On Thursday she would eat an omelet of four hundred eggs, not just eggs but the eggs of the world’s traders

On Friday, she would chew a lot, very much.

And on Saturday?

On Saturday she would not eat anything because on Saturday she always had terrible stomachaches…

Until………………………………………… ………….. on the day ……………………………. ………..

She vomited it all up

|

| markets forecast |

as you all can see its happen, in the last year the markets went up in high pct , after this post was written i checked again the situation in 2017 and post new forecast: Let’s check my last post-2017 forecast was published

so far, the forecasts have hit, and the indices have achieved handsome returns in line with the forecast

Well let’s talk last mummer NFP in us last week: For the first time in seven years, the US employment market contracted the number of jobs fell by 33,000 in September, mainly due to Hurricane and Irma hurricanes; Analysts expected an addition of 90-80,000 jobs; however, the unemployment rate fell from 4.4% to 4.2%, the lowest since December 2000

On the other hand, markets and indices in the US continue to break records day after day and rise for more than 9 consecutive years

Optimism seems to be at its peak, and nothing will stop this train of surprises.

It seems that nothing will stop the machine, no threats from the north and south No crises No storms is a machine immune to all

is that so?

|

| dow jones price |

|

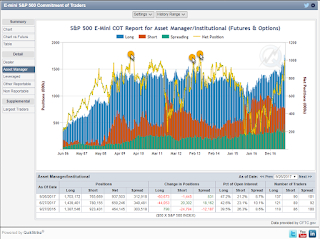

| cot position |

|

| sp 500 position |

Technical analysis pattern :

Do you all remember the chart and pattern I raised at the time in 2016 forecast:

The goals have long been achieved one by one, now if we look at the pattern again, we will notice that it becomes deep crab This pattern is valid when price respects and bounces off of the XA swing high swing low to form point B at the 88.6% Fibonacci retracement level. The target of point D is beyond the origin of XA and is 1.618 of XA – now if we will look the chart again so we can more distant goals, which can be derived and derived from deepening the pattern, are in areas of price levels such as 23,300+_ and even more high at 24,600-25,100 price area ,while the opposite direction can cause the dow jones to move lower to test crucial areas in 22,100-22,400 – those levels seem to have strong support .one more thing for finish is to test one indicator – as you can see in the chart only one time in the past, he breaks up the red line (extreme situation) -this movement was in 2008 and bring more 3000 points from the break, so, if we will go now those days, its give us the same target as I mention above apx 24,000 +

|

| MARKETS 2017 FORECAST REVIEW |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice