markets forecast technical analysis update

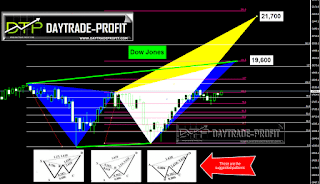

Im wrote many times during the last two years on the similarly situation in the markets who remind me 1999 , you can see here all the story

i thought we need to get some corrections before continuing upper levels , but there was only small pick for two days to test lows and recovers very fast even higher points than it was on the Nasdaq and sp500

The story for 2017 : 2017 Recession Or Records In The Markets ?

|

markets forecast |

We have important data during this week :

US Nonfarm Payrolls on Friday

Jobs growth bounced back in April following a pretty lackluster performance in March, stiffening expectations that the Federal Reserve faces few obstacles to raising rates at its June meeting.

With the FOMC convening in a fortnight’s time for that crunch decision, Friday’s nonfarm payrolls (NFP) will be as closely watched as ever for clues about how strong the US economy appears.

Weighing on any positivity in the report are renewed doubts about the reflationary policies of president Trump, which has forced two of the biggest investment banks to trim their bond yield forecasts for 2018. Nevertheless, the monthly NFP release should provide all the usual volatility in US Treasuries, the dollar and equity markets. The private ADP nonfarm report on Wednesday will also be keenly awaited as it can give clues about the official data release two days’ later.

Eu- German inflation

The inflation data will be watched especially closely by euro traders as it comes shortly before the European Central Bank’s meeting next week. Rising inflation and growth, combined with receding political risk, is putting pressure on the ECB to consider tightening monetary policy faster than planned. Investors are already acting, with EURUSD climbing to multi-month highs in recent days. A big spike in underlying CPI inflation could send the euro higher if the ECB does seem minded to act.

UK economy

The upcoming General Election is likely to offer continued interest for traders as sterling flirts with an eight-month high around $1.30. Recent polls showing a Labour surge suggest Theresa May’s Conservative party might not be a shoo-in for a thumping majority. If Labour continues to narrow the gap expect heightened volatility in sterling pairs, with the pound exposed to political risks associated with Brexit negotiations set to start just a week after the June 8th poll.

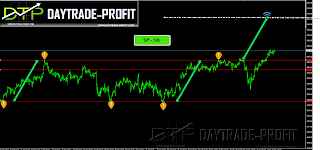

now in your permit ion please I want to attend your thoughts and look to the chart’s : we can see in the sp 500 the range : im expecting to see the sp 500 go to 2460-2487 price levels

|

| sp 500 analysis |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice

www.daytrade-profit.com