Will the GBP USD find its price above 1.30

Today Will post some major economic data on England

BOE Inflation Report

MPC Official Bank Rate Votes

Monetary Policy Summary

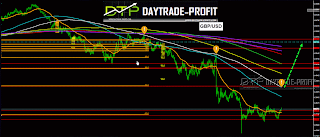

“Now, after a few explanations, go to the price chart and see the picture:

|

| GBP USD |

Why it matters: One of the nine-strong MPC voted for a hike in March, while several others indicated they were close to doing the same. Since then inflation has jumped above the Bank’s target level to 2.3% and stayed there.

The Bank of England meeting, therefore, comes at an important moment for cable and the tone of the Monetary Policy Committee

Brexit. While the UK economy has proved resilient since the EU referendum last June, there are signs of cracks appearing. Given the uncertainty, the Bank would likely judge it as being undesirable to embark on tightening when it could choke the life out of the economy.

Does the data support a hike or, more pertinently, for some more members to call for one? CPI rose to 1.8% in January and since the last BoE meeting, we have this rise to 2.3%, where it has held for two months. This is noteworthy for two reasons. First, it is above the Bank’s target, which ought normally to be a signal that rates may rise soon. Second, having accelerated in recent months, price growth has now stabilized and the threat of runaway inflation seems to have abated, although economists still expect it to climb further. The Bank may decide that inflation may not rise as fast as previously thought, which ought to further dampen calls to raise rates soon.

Growth, on the other hand, has failed to match inflation. GDP growth sank to just 0.3% in Q1 from 0.7% in the preceding quarter. Annual growth came in at 2.1%, just shy of forecasts. The bank may well scale back its growth forecasts for the year. The data is not particularly supportive of a change in policy, being too lackluster to warrant tightening but certainly not so weak that further accommodation is required. The Bank is, therefore, likely to stick to its view that “there are risks in both directions”.

From technical view we can see some things:

Expect strong resistance below 1.3300 to bring larger down trend resumption, while we have first to meet 1.3080 . On the downside, break of 1.2860 support will indicate short-term topping. If it will fail to stay above the level it will be turned back to the downside for 1.2640 support

|

| GBP USD TECHNICAL ANALYSIS |

This review does not including any document and/or file attached to it as an advice or recommendation to buy/sell securities and/or other advice