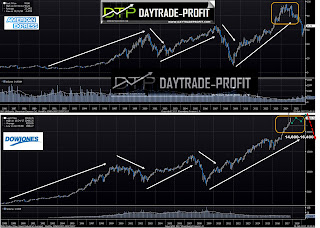

Financial markets upcoming moves forecast update

In the previous post on the markets, I talked about the monster markets

I am covering those moves since 17,800 points on the dowjones+_ apx and suggest here the upcoming future move – The forecast materialized

|

| markets forecast |

It seems that nothing will stop the machine, no threats from the north and south No crises No storms

In the nine years since the outbreak of the global financial crisis of 2008, there has been panic in the markets. At the end of 2015 and the beginning of 2016, for example, it seemed for a moment that they were collapsing along with the Chinese stock exchanges, the price of oil and the European banks – but the recovery was very rapid.

Global growth, which we have not seen for many years, zero inflation and low-interest rates, together with expectations of an increase in corporate profits during the current reporting season, have led to money desperately seeking yields and continuing to flow into stock markets.

The Dow Jones Industrial Average, which is the 2008 crisis collapsed from 14,000 to 6,500 in five months, is currently at a record high of more than 23,000.

Did you know that there are shares that tainted more than 1000%, Yes Yes you heard correctly:

Stocks like Boeing and Home Depot have grown at amazing rates …..

|

| markets moves |

In the year since the election, Trump has done nothing to support growth. Lots of intentions, lots of talks. Meanwhile, he has not been able to cut taxes and promote investment in infrastructure. However, he recently managed to pass the 2018 budget in the Senate. Trump is hard to decipher. The markets are a little euphoric about him and everyone is now waiting for the tax plan

But unexpected things can happen – for example about Trump’s trade restrictions or the tax reform he has declared, which requires funding; What is not clear right now is how to finance this beautiful reform

In the United States, multiplier levels are rising all the time – that is, share prices are rising faster than companies’ profits. All this happens in parallel to very low-interest rates and very moderate inflationary pressures.

However, it is forbidden to be complacent – and it is worth monitoring the activity of the central banks, noting that there is no situation in which inflation starts to rise faster than market expectations. The current chairman of the Fed, Janet Yellen, has raised interest rates so far at a slow pace – but its replacement, whose identity is still unknown, may adopt a policy of much faster interest rate increases. Today, the interest rate can be raised faster, because of the recovery in corporate profits and growth, and it is possible that the next Fed Chairman will decide to accelerate the pace.

|

| markets collapse |

Now let’s go to check the interesting things that caught my eyes :

|

| dow jones vs stocks |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice