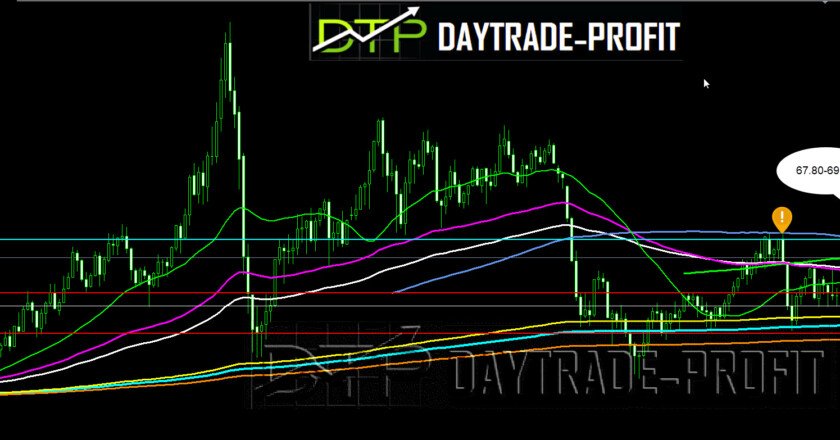

EUR USD Technical Analysis

EUR/USD succeeded to take out 1.15 support, break up again on daily basis 1.1760-price level will confirm medium term rally resumption and target next key at 1.1860 and even 1.2080 However, sustained price below will extend the consolidation pattern from 1.2091 with another decline through 1.1350 support- break again last lows will confirm for more downtrend to closed old GAP from 2016 who located in 1.0770 price area

For trend resistance strip – Until when the Euro-Dollar pair will be traded in a shuffle and indecision trend? – Targets archived!

As I wrote last post EUR/USD we will see retracement – closed daily above 1.1430 will lead to 1.1630 and even more up targets such as 1.1670 and even 1.1740

|

| EUR USD analysis |

EUR/USD surged to as high as 1.1801 last week its highest since mid-June but failed to sustain above 1.1800 and finished Friday at 1.1745, This week, the main macroeconomic event will be the US Federal Reserve meeting, The central bank is expected to raise rates by 25bps, something the market has priced in long ago. Whether the market decides to lift odds of a fourth, hike in December or take them down after the meeting’s outcome, will give the US dollar the trend ahead

The potential risks for the EUR are The fundamental problem of the Eurozone remains, which is the north/south divide in terms of economic strength, unemployment, and productivity.

For the US Dollar, the main concern in the short term is the Trump administration’s aggressive trade policy. They are starting fights with some very powerful opponents such as China, and such moves can damage future US potential. The NAFTA talks

This review does not include any document and/or file attached to it as an advice or recommendation to buy/sell securities and/or other advice

www.daytrade-profit.com