Markets Technical Analysis

As early as December 2021, there were signs on the board that this time it would be different…

Are there any signs of the coming future for stock markets in 2022?

This year started unusually and it and it seems right now that it will remain like this….

In January before the war between Ukraine and Russia started I post:

A phase of declines in the markets or momentary intimidation

After that things became messier and in February I post: An unusual year started how will it end?

Now we see recovers on markets – are they real and we may see a new high or it’s just a pause before another leg down

The situation is very tricky unclear and the danger has not yet passed Maximum care is required

Markets still cruising in negative territory – has not moved to a definite long move!

At the moment it is still defined as a correction to the declines we have experienced

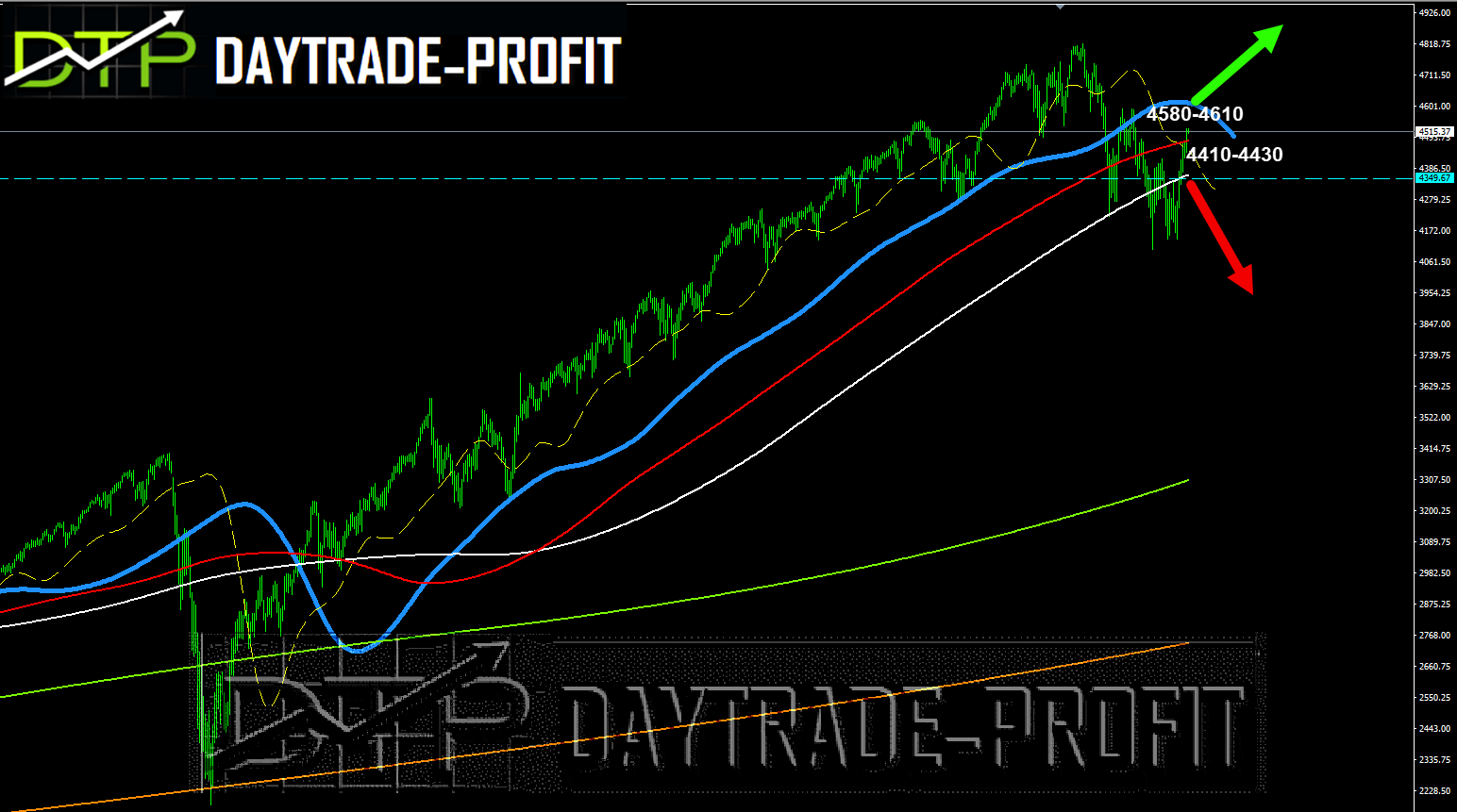

To summarize things – short term:

stay Long is a trend as long as the S&P 500 is trading above 4410 points levels

Short term: Breaking area above 4583 ,will lead to the area I mentioned with a stop on the 4410 points and reinforcement above area level 4620 points

Short term: Breaking down area 4410 will lead to 4360 area with licking to 4260 – Below the story changes!

Long term – caution till blue strip cross up again (4610 pints)

Energy, food, and housing prices are rising rapidly, with central banks raising interest rates for the first time since 2018 in an attempt to control the inflationary eruption

War is still raging in Europe…..

The corona is here for the time being on a small fire and hopefully, he will describe it that way

The chip crisis is still here

Logistical and supply problems exist all over the world

It will take time to know what the full impact of global interest rate hikes will be on the markets – how many times will they rise? How fast will they go up? What interest rates will we get?

And maybe all this news is already priced and there is no surprise here

The big question here is do we witness the retail investors are buying the dip hoping to get a bargain, while the institutional investors are selling the rally, or rather institutional investors Equipped with goods based on expectations for the future, and think that there are bargain prices in the market

In 2018 we saw the same recovery up to green strip and failed hard from there that’s why I keep telling you that caution is required!

his review does not include any document and/or file attached to it as advice or recommendation to buy/sell securities and/or other advice