Stock Market Technical Analysis Forecast

Since last records on markets (in end of January), and the beginning of corrections in February the price looks like searching for balanced and direction – the last post was talked about patterns who suggest for more moves

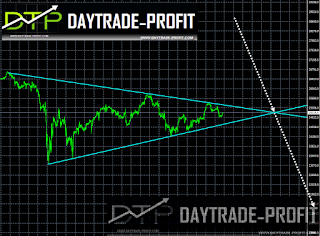

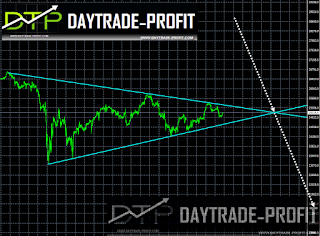

Bedside this post we can see also now the triangle pattern in Dow Jones index – break up or down?

Yesterday we heard that President Trump would swiftly impose sweeping tariffs on Chinese imports, it turns the market to negative territory, also don’t forget that next week there is Federal Funds Rate decision – the expectation is to raise in 0.25 points (any other step will be surprised)

The indices have indeed corrected well and now a majority reach critical test levels If the assumption of two trading patterns that can be formed will be implemented Then interesting and beautiful movements can be expected

Currently, the markets are very volatile and nervous, I’m expecting to see the index test lows next week: sp500 to 2670+_ price area, Dow Jones to 24,100+_ price area

|

| markets forecast |

The indices have indeed corrected well and now a majority reach critical test levels in my opinion If the assumption of two trading patterns that can be formed will be implemented Then interesting and beautiful movements can be expected

The indices made pullback’s after reach high side as was written here,

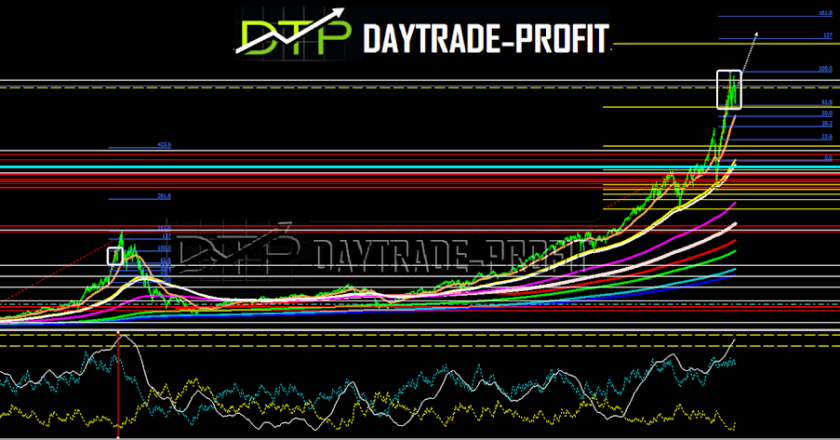

A 38.2%-50% retracement is the minimum requirement for a pullback, and this requirement has been achieved

The medium-long term since last major downtrend start to see some bullish sign on the chart since 3 weeks ago, you can see the price belt support in the blue color crosses – as long the prices remain above it will confirm for more bullish to come

|

| markets pattern |

if you follow last posts, you all know and showed last predictions and wasn’t surprised

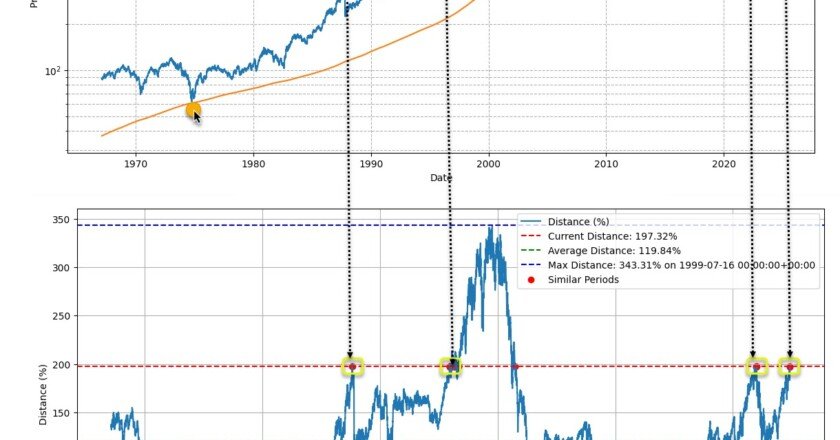

“” According to the sentiment and the graph, we are on the edge and therefore I think this is the point in which it is worth trying to check whether it will work

I am talking about trading, of course, on the indices when I assume that the markets are in the process of correcting whether I am healthy or not yet know

But patch down almost certainly – with a probability of more than 70%

Let’s build a test strategy

Short position with a stop of 3-4% and profit 7-8%

A ratio of 1: 2 in terms of chance of risk”

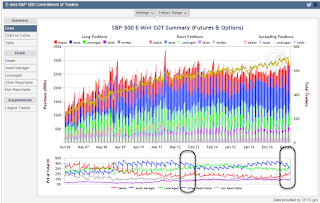

The last Thing about Cot position map shows same behavior in last 2012 quarter

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice

www.daytrade-profit.com