MARKTES FORECAST TECHNICAL ANALYSIS

sp500 index is still in consolidation, a closer inspection reveals some bullish indications- My assumption that we are going to see the index in 2180-2200 numbers at first quarter of 2016

Any break below 2000 will take the index further down till 1867. Long term weakness can be seen only below 1860 level

The previous peak was formed around 2137 in May, from there the index made new lows at last august 1833

Some of the lagging indicators are also now turning bullish, the last time the SP500 saw the same pattern was in early 2012, which cause the index to climb steadily for the next few months

2016 outlook is supportive of equities driven by improving global growth, slowly rising interest rates, a stronger U.S. dollar, and low inflation, Technology and Financials remain the two largest sectors within the SP 500 at 37% of the SP 500 and since they had their absolutely crushing bear markets in the last decade. Managing the “risks,” and rebalancing portfolios accordingly, should be the key for successful investing in the New Year.

about the nasdaq 100 ……

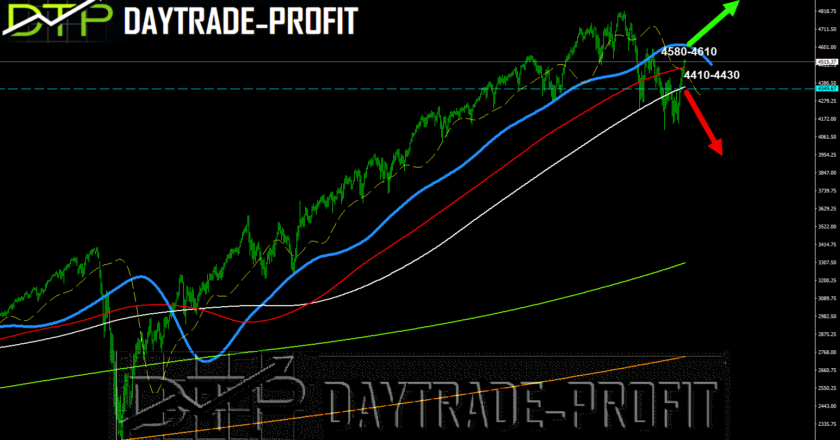

Nasdaq100 forecast :

close look show us that this index has the most powerfull trend,consolidation stay in 4480 area to 4740 – break up /down those levels will lead to 5000 area the up side or 4237 on the lower side

good luck to all and happy new year

|

| nasdaq |

|

| s&p500 |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice