stock market analysis

Fed Chairman Jerome Powell hinted yesterday that the pace of interest rate hikes had slowed, saying the interest rate was close to the level and natural environment.

This raises the speculation that there were no interest rate hikes seen in the market as they expected to speak, those talk sent the indices leading to sharp rises Amazon jumped 6 %. In accordance with the interpretation, the dollar index declined against the currency basket.

On the other hand, everything is not so pink

World Monetary Fund (IMF) chairwoman Christine Lagarde warned yesterday that the global economy’s growth rate may be lower than expected.

The Fed warns of sharp falls in the markets tonight

“The historically high market value, the continued increases in the interest rate and the reduction of the balance sheet together with the geopolitical tensions may create an extreme event in the market”

also The bank said that the current rate hikes could pose a threat to the economy and that the markets, which have become accustomed to zero interest rates, may face difficulties – for example, the real estate sector: asset prices may decline significantly and put pressure on the sector, which is already at a high leverage level .

This week is not over yet there is the weekend summit (G20) with many bombs – trade war due to the increase in customs duties and import taxes by the US government, a trade war could hurt the economic recovery and lower growth rates, US-China issue continues to affect sentiment in the markets.

Emerging economies already experiencing a slowdown in growth, and if no agreement is reached, the situation may worsen.

|

| markets analysis |

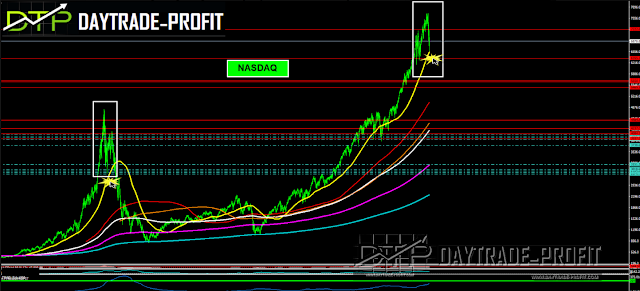

Technical analysis for the NASDAQ:

If we take a good look and want to know whether we are entering a bear market or turning into a new record we should focus on

The 6350 level price in NASDAQ this is the key level for a bull market or bear market

for the short-term technical view, the targets are

6880 7020 7080 7130

|

| NASDAQ analysis |

|

| NASDAQ chart |

Has the crash reached financial markets and a new era is ahead of us?

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice