The Commitments of Traders (COT) are based on CoT reports which are published by the CFTC each Friday on 19:30 GMT.

The Commitments of Traders Report is issued by CFTC.

Each CoT report includes a breakdown of each Tuesday’s open interest for markets in which 20 or more traders hold positions equal to or above the reporting levels established by the CFTC, The Commitments of Traders (COT) report provides a breakdown of each Tuesday’s open interest for markets in which 20 or more traders hold positions equal to or above the reporting levels established by the CFTC, every Friday and includes data from Tuesday to Tuesday. The three days prior to the release date are not included.

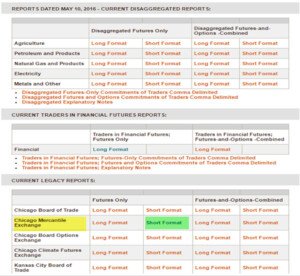

You can see the data here:

http://www.cftc.gov/MarketReports/CommitmentsofTraders/index.htm

https://www.cmegroup.com/tools-information/quikstrike/commitment-of-traders-agricultural.html

apply Information about changes in the position commitments of traders, those changes ac tell us a lot of things: Flips in the overall positioning may be an accurate trending indicator

- Extreme positioning has historically been accurate in identifying FX market reversals

- Changes in the overall number of contracts can be used to determine the strength of a trend

How to use it.

The COT report is designed to gauge the supply and demand of important market participants.

It is useful for long-term traders as it helps you identify extreme net long or net short positions. And when you see such extreme positions, it usually means that a market reversal is just around the corner It can be used to confirm mid/long term fundamental bias in a given market.

First, you should pick your interest, I am usually using the CME –Short Format

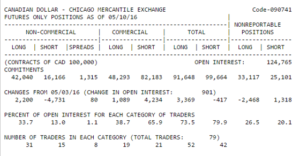

Second, you will get the data:

It’s divided a group of traders: Commercial Traders – Hedgers companies and banks

Non-Commercial Traders – Money Managers and financial institutions

Non-Reportable – Retail market

The “open interest” number is the total number of open contracts (purchases and sales) made by all types of traders.

On the second line, you see the changes from last week.

On the last line, you see the number of traders holding these positions. These are traders whose positions are large enough that they have to report them to the CFTC.

Analyze COT Data :

You should monitoring how these positions change over time, need to find out if they are adding more to their positions or they are starting to reduce contracts over time. To make the COT data useful, we need to store data, so we can plot charts and see how positions are changing over time

It’s divided into groups of traders:

Commercial Hedgers – The largest positions are usually held by commercial institutions or hedgers – considered the most knowledgeable and are the most important group.

Large Traders – typically hedge funds, banks, and Commodity Trading Advisors (CTA)- trading purely for profit

Small Speculators – This group of traders is generally thought to be small speculators, hedgers, and retail traders who are not holding a position large enough to report to the CFTC.

Dealer/Intermediary – include large banks and dealers in securities, swaps, and other derivatives.

Asset Manager/Institutional – Institutional investors, including pension funds, insurance companies, mutual funds, and portfolio/investment managers whose clients are predominantly institutional.

Leveraged Funds – Typically hedge funds and various types of money managers, including registered Commodity Trading Advisors (CTAs), Commodity Pool Operators (CPOs) or unregistered funds identified by CFTC. T

Other Reportable – Reportable traders that are not placed into one of the first three groups. Most are using markets to hedge business risk

The changes in major trader positions – Commercials and Large Traders are important because they drive trends. Commercials are often in the opposite direction of the market trends. They are actively buying when the market is declining and actively selling when the market is rising. They are the experts in their businesses and often are acting many months in advance of where they expect the price to be. Commercials are the ones that really move the markets and start the trends, Large Traders typically trade trend following systems with volume (the trends only being initiated by Commercials). Large Traders usually don’t enter all at once and they pyramid their positions. Small Traders are wrong most of the time and their net position is usually vulnerable to either long liquidation or short covering if the market starts to move against them.

monitoring Commercials (negatively) and Large Traders (positively) positions can act as a confirmation for trade signals given by the price action.

A typical bull setup can be when Large Traders are net-long and Small Speculators are net short. You should be warned when the trend in the Large Traders position is going down and the funds are starting to liquidate their net long position. Bear setup exists when Large Traders are holding a net short position and Small Speculators net long position.