Market sentiment is driven by the crowd or herd psychology of the traders- shows the current disposition of traders relative to a specific instrument

How many traders are holding long positions and how many are holding short positions, can be a useful tool to help traders understand and act on price behavior

Sentiment analysis can be directly translated to forex, it is also used for stocks and other assets.

Sentiment indicators show how optimistic or pessimistic traders are about market conditions. This can refer to the percentage of trades that have taken a given position in a currency pair.

The behavior of the crowd is a significant indicator of the forex market sentiment. When optimism is at its peak- means that more than 70% of traders are long, one should choose to sell, and similarly when pessimism peaks -more than 70% of traders are short, and the market appears to have bottomed out, one should purchase.

you should watch closely on the trend traders vs instrument price – most of the traders tend to sell when the trend is going up and And reverse when the trend is going down.

You would need to combine information from several brokers to get a more precise picture Because it is difficult to put exactly the finger on the point of overturning so the best way is to keep track of the number of brokers and focus on the time of the trend – price change – and position change

This way you will be able to better assess the market situation and get the most out of it

There is a saying:

“90% of retailers lose money in the market”

Hence trading against the crowd could be a profitable trading strategy

let’s move on to the sources

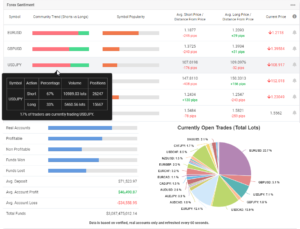

Myfxbook being a big community of traders, and retail trading psychology being the same, it is reflective of the whole retail Forex trading community. data is composed of retail traders’ live trading accounts

Above is data for each individual currency retail position. It will show the number of long positions versus short positions, the amount traded for that currency pair compared to others (symbol popularity), average short price (plus the current price distance from it), and average long price (plus the current price distance from it), Data is based on verified, real accounts only and refreshed every 60 seconds

ForexFactory community website for traders. their sentiment based on the accounts of the traders who voluntarily signed up with ForexFactory and connected their live account to the website. This results in a limited, it is possible to view the details for an individual currency pair. They include Traders, Lots, Average Entry Price, Average Trade Duration, Winning Trades, and Losing Trades. details show a chart for lots/traders in 5m, 1h, or day time frame.

investing is a financial platform and news website; one of the top three global financial websites in the world: where you can see forex, indices, crypto, stocks, you can see member sentiment: bullish vs bearish

Dukascopy the sentiment is divided into two parts — Liquidity Consumers and Liquidity Providers. The former is comprised of regular traders, money managers, and hedge funds. Even if they use limit and stop orders, they are counted as liquidity consumers as they do not do it on a regular basis. Providers are banks and currency marketplaces that regularly set up bids and offers for other participants to trade on. Each trade in one category has a corresponding trade-in another one.

Saxo Bank FX Open Orders and FX Open Positions chartsAggregated Open Orders. Order sizes and buys/sell ratios.

Clicking on an instrument will open three other charts:

Normalized Net Orders — the relative proportion of buy and sell orders at a given point in time.

Instrument Open Orders — shows a number of buys and sell orders at given price points.

Price Chart — currency pair price chart.

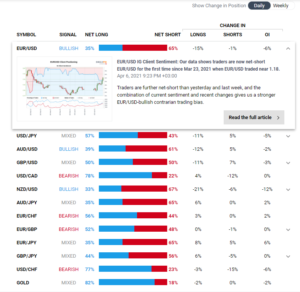

IG Client Sentiment

The data includes the current sentiment breakdown for the number of long/short positions and a daily and weekly sentiment change in the number of longs and shorts, and in open interest. The data is given for all major Forex pairs, gold, silver, and some stock market indices

How to use IG client sentiment

How to use IG client sentiment