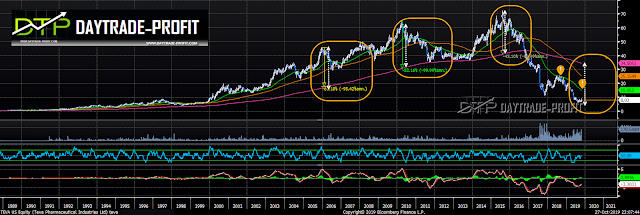

Is there an extraordinary investment potential here

I usually refrain from referring to one stock or another – unless it’s something interesting that is worth looking at and examining

It seems to me that we have here an interesting case of a stock that was once in the status of a major in the medical sector

This stock is Warren Buffet’s holdings and they lose quite a bit of money on Teva

At its peak, Teva was almost $ 80, and a month ago hits its last low was around $ 6.

Teva stock, I won’t go into economic data and explanations that can be found on all the economic sites on the Internet

It is true that from a business and economic standpoint, there is currently no catalyst for improving its financial situation, and the company needs a lot of money – recently entered into a settlement under the opioid affair, but as you already know me, the economic side you see does not always reflect the situation below the surface. what they Are they telling?

they tell an interesting story – notice the three cases in the past that the stock was trading at such a distance from the equilibrium strip – is this the case again this time, or is it a case where the end of a knife falls and it will cut the pocket and make a hole.

Technically, in terms of risk, this is a situation worth examining for a measured depth of entry and checking the pulse in a natural stock with a long stop of course in the $ 4 range which is 50% of the price now that it trades around $ 8

Goals: Gap closing to $ 14-15 – 75% return on the current price

Very distant and seems to be delusional at the moment – $ 30-34 – 400% return on the current price

|

| stocks analysis |

This review does not include any document and/or file attached to it as advice or recommendation to buy/sell securities and/or other advice