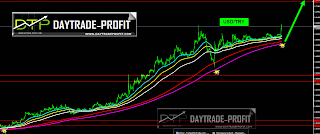

Turkish lira 2017 Forecast Technical analysis

2017 opened with massive movements on currency markets, with an impressive strengthening of the dollar against all currencies

Turkish Lira all-time low, what next?

My last post on the Turkish Lira:

I want to turn your attention, to identify trends in the market in recent years, how the Turkish lira was behaved in those specific region, seeing see graph on 08/12/2016 repair was exactly the point.

|

| Turkish lira forecast |

Today we have a new low of all time in the Turkish lira, where do we go from here?

So that in terms of technical patterns, we have a triangle / wedge, which means that if there will be a breakout, and the Turkish lira will continue over the levels of 3.62 area I expect rapid target of 3.72 to 82 in the first stage

On how to proceed did not rule out the arrival of the pair to the 4.11 + _

But let’s look first breakthrough is indeed a reliable burglary and breaching comparing I believe this false break and did not expect to see the areas I mentioned

As long as the Turkish lira will remain above 3.48 price area the trend will continue !

|

| USD/TRY |

In addition to technical analysis has also other variables that support the weakening of the Turkish lira:

The political and security situation in Turkey

The strengthening of the dollar worldwide

|

| USD/TRY forecast |

Forecasts of banks which I am less fond 🙂 quite match my appreciation

“Barclays 2017/2018 Forecasts See USD / TRY Exchange Rate Appreciation To 3.80 And 3.85”

Turkish Lira Forecasts are projected using an autoregressive integrated moving average (ARIMA) model calibrated using our analysts expectations. We model the past behavior of Turkish Lira using vast amounts of historical data and we adjust the coefficients of the econometric model by taking into account our analysts assessments and future expectations

“Morgan Stanley there is little to look forward to for Lira bulls: the bank expects the Lira to hit 3.60 per dollar in about 6 months, and 3.70 by the end of 2017”

“USD / TRY As the worst performer in the emerging markets universe over the past three months, the Turkish lira continues to be embraced by a perfect storm: a combination of deteriorating domestic policy, geopolitical uncertainty, the Fed’s more hawkish stance and weakening economic growth. The rising oil price is putting additional pressure on the current account and the TRY in the long run We still exclude aggressive hikes by the central bank in 2017 as we believe political pressure would encumber the bank”.

just one more thing ,pay attention to the over all trend in the past ,i had marked the crucial points whom suggest the same moves- if this pattern is the same behavior we should expect to see more

|

| USD /TRY ANALYSIS |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice